Black Monday (2020)

This article may be affected by the following current event: Black Thursday (2020). Information in this article may change rapidly as the event progresses. Initial news reports may be unreliable. The last updates to this article may not reflect the most current information. (March 2020) |

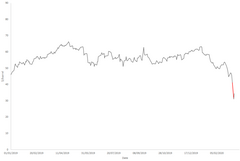

Movement of WTI price from 2019, with Black Monday changes highlighted in red. | |

| Date | 9 March 2020 |

|---|---|

| Type | Stock market crash |

| Cause |

|

| Outcome | The Dow Jones Industrial Average enters a bear market on 11 March 2020[1] |

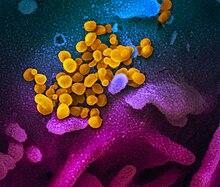

Black Monday was a global stock market crash on 9 March 2020 that occurred during the 2020 stock market crash.[2] Markets opened several percent lower, having fallen greatly during the preceding two weeks. Global stock markets suffered from the greatest single-day fall since 2008, during the Great Recession.[3] This record crash was soon surpassed three days later on Black Thursday. Notable contributing factors included the COVID-19 pandemic and the Russia–Saudi Arabia oil price war.[2][4][5]

In the United States, a trading curb, or circuit breaker, was triggered after stocks dropped sharply, halting trade for 15 minutes.[6] The FTSE 100 Index opened 560 points (8.6%) lower to 5920.[2] Indices in Asia, continental Europe, and the United States also fell by several percent on the same day, with the worst affected, Italy's FTSE MIB, opening 11% lower.[7] Other financial market effects included a rush to the safety of government bonds as 10-year American Treasury yields fell below 0.5% for the first time ever, appreciation of the Japanese yen, and gold rising above $1,700/ounce for the first time in seven years.[8]

Background

COVID-19 pandemic-induced instability

The stock market had been extremely volatile ever since Monday, 24 February 2020, when the Dow Jones Industrial Average and FTSE 100 dropped more than 3% as the COVID-19 pandemic spread worsened substantially outside China over the weekend.[10][11] On 27 February, the NASDAQ-100, the S&P 500 Index, and the Dow Jones Industrial Average posted their sharpest falls since 2008, with the Dow falling 1,191 points, its largest one-day drop since the 2008 financial crisis.[12] On 28 February, stock markets worldwide reported their largest single-week declines since the 2008 financial crisis.[13][11][14] The Federal Open Market Committee lowered the federal funds rate target by 50 basis points with Federal Reserve Chair Powell stating that the central bank "saw a risk to the outlook for the economy and chose to act" and that "the magnitude and persistence of the overall effect [of the outbreak] on the U.S. economy remain highly uncertain".[15][16] At the close of trading on 3 March, European and Asia-Pacific stock markets had mostly risen,[17][18] but the S&P 500, the NASDAQ Composite, and the Dow Jones Industrial Average all fell (with the Dow reversing more than two-thirds of the previous day's gain),[19] and the yield on 10-year and 30-year U.S. Treasury securities fell to record lows (with the yield on the 10-year securities falling below 1% for the first time in history).[20] Over the next several weeks, despite rate cuts, the market continued to struggle.

Russia–Saudi Arabia oil price war

The reduction in the demand for travel and the lack of factory activity due to the outbreak significantly impacted demand for oil, causing its price to fall.[21] In mid-February, the International Energy Agency forecasted that oil demand growth in 2020 would be the smallest since 2011.[22] Chinese demand slump resulted in a meeting of the Organization of Petroleum Exporting Countries (OPEC) to discuss a potential cut in production to balance the loss in demand.[23] The cartel initially made a tentative agreement to cut oil production by 1.5 million barrels per day following a meeting in Vienna on 5 March 2020, which would bring the production levels to the lowest it has been since the Iraq War.[24]

On 8 March 2020, Saudi Arabia unexpectedly announced that it would increase production of crude oil and sell it at a discount (of $6–8 a barrel) to customers in Asia, the US, and Europe, following the breakdown of negotiations as Russia resisted calls to cut production. The biggest discounts targeted Russian oil customers in northwestern Europe.[8]

Prior to the announcement, the price of oil had gone down by more than 30% since the start of the year, and upon Saudi Arabia's announcement it dropped a further 30 percent, though later recovered somewhat.[25][26] Brent Crude, used to price two-thirds of the world's crude oil supplies, experienced the largest drop since the 1991 Gulf War on the night of 8 March. Also, the price of West Texas Intermediate fell to its lowest level since February 2016.[27] Energy expert Bob McNally noted, "This is the first time since 1930 and '31 that a massive negative demand shock has coincided with a supply shock;"[28] in that case it was the Smoot–Hawley Tariff Act precipitating a collapse in international trade during the Great Depression, coinciding with discovery of the East Texas Oil Field during the Texas oil boom. Fears of the Russian–Saudi Arabian oil price war caused a plunge in U.S. stocks, and have had a particular impact on American producers of shale oil.[29]

Crash

| Rank | Date | Close | Change | Ref | |

|---|---|---|---|---|---|

| Net | % | ||||

| 1 | 2020-03-09 | 23,851.02 | −2,013.76 | −7.8 | [30] |

| 2 | 2020-02-27 | 25,766.64 | −1,190.95 | −4.4 | [31] |

| 3 | 2018-02-05 | 24,345.75 | −1,175.21 | −4.6 | [32] |

| 4 | 2018-02-08 | 23,860.46 | −1,032.89 | −4.2 | [33] |

| 5 | 2020-02-24 | 27,960.80 | −1,031.61 | −3.6 | [34] |

Prior to opening, the Dow Jones Industrial Average futures market experienced a 1,300 point drop based on the coronavirus and fall in the oil price described above, triggering a trading curb, or circuit breaker, that caused the futures market to suspend trading for 15 minutes.[6] This predicted 1,300 point drop would establish 9 March as being among the most points the Dow Jones Industrial Average has dropped in a single day.[35][36] When the market opened on 9 March, the Dow Jones Industrial Average plummeted 1800 points on opening, 500 points lower than the prediction.[37]

The United States' Dow Jones Industrial Average lost more than 2000 points,[38] described by The News International as "the biggest ever fall in intraday trading."[39] The Dow Jones Industrial Average hit a number of trading "circuit breakers" to curb panicked selling.[6] Oil firms Chevron and ExxonMobil fell about 15%.[40] The NASDAQ Composite, also in the United States, lost over 620 points.[clarification needed] The S&P 500 fell by 7.6%.[41] Canada's S&P/TSX Composite Index finished the day off by more than 10%.[42] Brazil's IBOVESPA gave up 12%, erasing over 15 months of gains for the index.[43] Australia's ASX 200 lost 7.3% – its biggest daily drop since 2008.[44][45] Though the ASX rebounded later in the day. London's FTSE 100 lost 7.7%, suffering its worst drop since the 2008 financial crisis.[46][47] BP and Shell Oil experienced intraday price drops of nearly 20%[48] The FTSE MIB, CAC 40, and DAX tanked as well, with Italy affected the most as the coronavirus pandemic in the country continues. They fell 11.2%, 8.4%, and 7.9% respectively.[49][50][51]

In a number of Asian markets—Japan, Singapore, the Philippines and Indonesia—shares declined over 20% from their most recent peaks, entering bear market territory.[52] In Japan, the Nikkei 225 plummeted 5.1%.[53] In Singapore, the Straits Times Index fell 6.03%.[54] In China, the CSI 300 Index lost 3%.[55] In Hong Kong, the Hang Seng index sank 4.2%.[56] In Pakistan, the PSX saw the largest ever intra-day plunge in the country's history, losing 2,302 points or 6.0%. The market closed with the KSE 100 index down 3.1%.[57] In India, the BSE SENSEX closed 1,942 points lower at 35,635 while the NSE Nifty 50 was down by 538 points to 10,451.[58]

Etymology

As the hashtag #BlackMonday trended on Twitter,[59] news organizations such as the Associated Press,[60] The Economist,[61] and Yahoo Finance UK adopted the term on the day it occurred.[62] While The Guardian initially referred to it as "Crash Monday", they also later referred to it as "The Black Monday of 2020" to distinguish it from the 1987 crash of the same name.[63] The Associated Press also quoted an analyst of the Australian finance company OFX as saying, "A blend of shocks have sent the markets into a frenzy on what may only be described as 'Black Monday' ... A combination of a Russia vs. Saudi Arabia oil price war, a crash in equities, and escalations in coronavirus woes have created a killer cocktail to worsen last week’s hangover."[64]

Aftermath

On the following day of trading, US stocks recouped some of the losses which happened on Monday, rising by more than 4%.[65] This was attributed to a potential fiscal stimulus, such as a potential 0% payroll tax, being proposed by US President Donald Trump.[66] On Wednesday, however, stocks fell once more, and resulted in the DJIA entering a bear market (i.e. 20% drop from the most recent peak) for the first time in 11 years, ending the longest bull market in American stock market history.[67] On Thursday, all three major US trading indexes fell 7%, leading to another 15-minute circuit breaker that halted trading.[68]

See also

- Black Monday (1987)

- List of largest daily changes in the Dow Jones Industrial Average

- List of largest daily changes in the NASDAQ Composite

- List of largest daily changes in the S&P 500 Index

- Socio-economic impact of the 2019–20 coronavirus pandemic

References

- ^ "Dow closes in bear market amid volatile session". Fox Business. 11 March 2020. Retrieved 11 March 2020.

- ^ a b c Prynn, Jonathan, English, Simon, and Murphy, Joe."Black Monday: Fourth biggest City fall as coronavirus panic hits markets", Evening Standard, 9 March 2020. Retrieved 9 March 2020.

- ^ "Global stock markets post biggest falls since 2008 financial crisis". The Guardian. 9 March 2020. Retrieved 10 March 2020.

- ^ "Black Monday: Shares face biggest fall since financial crisis". BBC News. 9 March 2020. Archived from the original on 9 March 2020. Retrieved 9 March 2020.

Analysts described the market reaction as "utter carnage".

- ^ Li, Yun (8 March 2020). "Dow sinks 2,000 points in worst day since 2008, S&P 500 drops more than 7%". CNBC. Archived from the original on 9 March 2020. Retrieved 10 March 2020.

- ^ a b c "Global shares plunge in worst day since financial crisis". BBC. 9 March 2020. Archived from the original on 9 March 2020. Retrieved 10 March 2020.

- ^ "Oil and coronavirus fears spark 'Black Monday' for stock markets". finance.yahoo.com. Archived from the original on 9 March 2020. Retrieved 10 March 2020.

- ^ a b "Saudi-Russian price war sends oil and stockmarkets crashing". The Economist. 9 March 2020. Archived from the original on 9 March 2020. Retrieved 9 March 2020.

- ^ "New Images of Novel Coronavirus SARS-CoV-2 Now Available". NIH: National Institute of Allergy and Infectious Diseases. 13 February 2020. Archived from the original on 22 February 2020. Retrieved 1 March 2020 – via niaid.nih.gov.

- ^ "Global stock markets plunge on coronavirus fears". Archived from the original on 25 February 2020. Retrieved 25 February 2020.

- ^ a b Imbert, Fred; Huang, Eustance (27 February 2020). "Dow falls 350 points Friday to cap the worst week for Wall Street since the financial crisis". CNBC. Archived from the original on 28 February 2020. Retrieved 28 February 2020.

- ^ Tappe, Anneken (27 February 2020). "Dow falls 1,191 points – the most in history". CNN Business. CNN. Archived from the original on 28 February 2020. Retrieved 28 February 2020.

- ^ Smith, Elliot (28 February 2020). "Global stocks head for worst week since the financial crisis amid fears of a possible pandemic". CNBC. Archived from the original on 28 February 2020. Retrieved 28 February 2020.

- ^ Smith, Elliot (28 February 2020). "European stocks fall 12% on the week as coronavirus grips markets". CNBC. Archived from the original on 28 February 2020. Retrieved 28 February 2020.

- ^ Cox, Jeff (3 March 2020). "Fed cuts rates by half a percentage point to combat coronavirus slowdown". CNBC. Archived from the original on 4 March 2020. Retrieved 3 March 2020.

- ^ Cox, Jeff (3 March 2020). "Powell says the Fed saw 'a risk to the outlook for the economy and chose to act'". CNBC. Archived from the original on 4 March 2020. Retrieved 3 March 2020.

- ^ Huang, Eustance (2 March 2020). "Asia stocks edge higher as RBA cuts cash rate to new record low". CNBC. Archived from the original on 4 March 2020. Retrieved 3 March 2020.

- ^ Smith, Elliot; Ellyatt, Holly (3 March 2020). "European stocks close higher after emergency Fed rate cut". CNBC. Archived from the original on 3 March 2020. Retrieved 3 March 2020.

- ^ Imbert, Fred; Pound, Jesse; Huang, Eustance (2 March 2020). "Dow plunges more than 700 points despite the Fed cutting rates". CNBC. Archived from the original on 4 March 2020. Retrieved 3 March 2020.

- ^ Li, Yun (3 March 2020). "10-year Treasury yield falls below 1% for the first time after Fed slashes rates due to coronavirus". CNBC. Archived from the original on 4 March 2020. Retrieved 3 March 2020.

- ^ "Oil prices fall as coronavirus spreads outside China". AP. 29 February 2020. Archived from the original on 8 March 2020. Retrieved 9 March 2020.

- ^ "Coronavirus set to knock oil demand growth to slowest since 2011". Financial Times. 13 February 2020. Archived from the original on 14 February 2020. Retrieved 9 March 2020.

- ^ Kollewe, Julia (4 February 2020). "Opec discusses coronavirus as Chinese oil demand slumps – as it happened". The Guardian. Archived from the original on 6 February 2020. Retrieved 9 March 2020.

- ^ Johnson, Keith (5 March 2020). "OPEC Tries to Forestall a Coronavirus Oil Collapse". Foreign Policy. Archived from the original on 7 March 2020. Retrieved 9 March 2020.

- ^ Stevens, Pippa (8 March 2020). "Oil prices plunge as much as 30% after OPEC deal failure sparks price war". CNBC. Archived from the original on 9 March 2020. Retrieved 9 March 2020.

- ^ "Oil Prices, Stocks Plunge After Saudi Arabia Stuns World With Massive Discounts". NPR. 8 March 2020. Archived from the original on 10 March 2020. Retrieved 9 March 2020.

- ^ Telford, Taylor; Englund, Will; Heath, Thomas. "U.S. markets crater with stocks down more than 5 percent as coronavirus spreads". Washington Post. Archived from the original on 8 March 2020. Retrieved 9 March 2020.

- ^ Mufson, Steven; Englund, Will. "Oil price war threatens widespread collateral damage". Washington Post. Retrieved 9 March 2020.

- ^ Egan, Matt (9 March 2020). "Oil crashes by most since 1991 as Saudi Arabia launches price war". CNN. Archived from the original on 9 March 2020. Retrieved 9 March 2020.

- ^ "Dow sinks 2,000 points in worst day since 2008, S&P 500 drops more than 7%". CNBC. 9 March 2020. Retrieved 12 March 2020.

{{cite web}}: Cite has empty unknown parameter:|1=(help) - ^ "Dow Jones drops nearly 1,200 points, biggest point decline ever". krcrtv.com. 27 February 2020. Archived from the original on 27 February 2020. Retrieved 27 February 2020.

{{cite web}}: Cite has empty unknown parameter:|6=(help) - ^ Wang, Lu; Wittenstein, Jeran (5 February 2018). "Bad Day Turns Terrifying With the Dow's Dramatic Drop". Bloomberg News. Archived from the original on 6 February 2018. Retrieved 5 February 2018.

- ^ "Dow plunges 1,000 points as market swoons again". CBC News. 9 February 2018. Archived from the original on 8 February 2018. Retrieved 8 February 2018.

- ^ Imbert, Fred; Huang, Eustance (23 February 2020). "Dow plunges 1,000 points on coronavirus fears, 3.5% drop is worst in two years". cnbc.com. Archived from the original on 8 March 2020. Retrieved 10 March 2020.

- ^ Yun Li (8 March 2019). "Dow futures tumble as Saudi-Russia oil price war adds to coronavirus stress". NBC News. Archived from the original on 9 March 2020. Retrieved 9 March 2020.

- ^ Lucy Bayly (9 March 2020). "Dow closes with decline of 2,000 points, almost ending 11-year bull market". NBC News. Archived from the original on 9 March 2020. Retrieved 9 March 2020.

- ^ Stephanie Ruhle (9 March 2019). "Stocks plunge at market open, trading halts after Dow drops 1800 points". MSNBC.com.

- ^ Menton, Jessica. "Dow plummets 2,000 points, oil prices drop as global recession concerns mount". USA Today. Retrieved 10 March 2020.

- ^ "Trillions vaporise from world economy". thenews.com.pk. Retrieved 10 March 2020.

- ^ Reuters (9 March 2020). "Dow Dives 2,000 Points After Oil Shock". Haaretz. Retrieved 10 March 2020.

{{cite news}}:|last=has generic name (help) - ^ "Worst day in a decade: Nasdaq, S&P, Dow down nearly 8% in massive market rout". Fortune. Retrieved 10 March 2020.

- ^ Investing (9 March 2020). "TSX sinks 10.3%, U.S. stocks plunge most since the financial crisis | Financial Post". Retrieved 10 March 2020.

- ^ "Brazil stocks post biggest fall since 1998, central bank intervenes twice in FX". Reuters. 9 March 2020. Retrieved 10 March 2020.

- ^ "Australian shares drop most in over 11 years on virus fears, oil plunge". Reuters. 9 March 2020. Retrieved 10 March 2020.

- ^ "'Real fear': ASX plunges 7.3 per cent as $136b wiped from bourse". The Sydney Morning Herald. 9 March 2020. Retrieved 12 March 2020.

{{cite web}}: Cite has empty unknown parameter:|1=(help) - ^ Marris, Sharos (9 March 2020). "Coronavirus: FTSE 100 in biggest fall since 2008 financial crisis on outbreak fears". Sky News.

{{cite web}}: CS1 maint: url-status (link) - ^ Ashworth, Louis (9 March 2020). "Stock markets crash after oil price collapses". The Telegraph. ISSN 0307-1235. Retrieved 10 March 2020.

- ^ Ashworth, Louis (9 March 2020). "Stock markets crash after oil price collapses". The Telegraph. Retrieved 9 March 2020.

- ^ "FTSE falls 11% in a week as virus spreads". The Times. 9 March 2020. Archived from the original on 2 March 2020.

- ^ "FTSE tumbles 8.2% on opening rout". BBC. 9 March 2020. Archived from the original on 10 March 2020.

- ^ "US stocks halted after falling 7%. Global stocks plunge as oil crashes and coronavirus fear spreads". Q13 FOX. 9 March 2020.

{{cite web}}: CS1 maint: url-status (link) - ^ Vishnoi, Abhishek; Mookerjee, Ishika (9 March 2020). "Perfect Storm Plunges Asia Stocks Into Bear Markets One by One". Bloomberg. Retrieved 10 March 2020.

- ^ He, Laura (9 March 2020). "US stocks halted after falling 7%. Global stocks plunge as oil crashes and coronavirus fear spreads". 8 KPAX.

{{cite web}}: CS1 maint: url-status (link) - ^ Tang, See Kit (9 March 2020). "Singapore stocks near 4-year low as oil rout, COVID-19 fears send investors 'dumping everything'". CNA. Retrieved 10 March 2020.

- ^ "China stocks slide 3%, leading sharp losses for Asia as coronavirus spreads". Market Watch. 23 January 2020. Archived from the original on 10 March 2020.

- ^ Price, Deb (9 March 2020). "Hong Kong stocks plunge more than 1,100 points as collapsing oil market adds to the woes of a widening coronavirus outbreak". South China Morning Post. Archived from the original on 9 March 2020.

- ^ "Crash and recover: Stocks register largest intra-day fall in history before rebounding". Dawn. 9 March 2020.

- ^ Raj, Shubham (9 March 2020). "Monday mayhem marks worst day for Sensex: 5 factors causing this crash". The Economic Times. Retrieved 12 March 2020.

- ^ Grothaus, Michael (9 March 2020). "Black Monday: Stock markets plummet on coronavirus fears and oil price war". Fast Company. Retrieved 9 March 2020.

The volatility in the markets has led to the hashtag #BlackMonday trending on Twitter. "Black Monday" is, of course, a reference to large stock market crashes, particularly the one that happened in October 1987, which saw the Dow lose over 22% of its value in a single day. Whether today ends up being a new Black Monday in the history books, of course, depends on how trading continues throughout the day.

- ^ McDonald, Joe (9 March 2020). "Black Monday: Why global stocks and oil prices plunged". Associated Press. Retrieved 12 March 2020.

- ^ "How market panic can feed back to the world economy". The Economist. 9 March 2020. Archived from the original on 10 March 2020. Retrieved 10 March 2020.

- ^ Belger, Tom (9 March 2020). "FTSE nosedives as oil shock wipes billions off stocks on 'Black Monday'". Yahoo Finance UK. Archived from the original on 9 March 2020. Retrieved 9 March 2020.

"This will be remembered as Black Monday. If you thought it couldn't get any worse than the last fortnight, think again... it's utter carnage out there," said Neil Wilson, chief market analyst at Markets.com.

- ^ Elliot, Larry (9 March 2020). "'Crash Monday' is the price we're paying for a decade of cheap money". The Guardian (UK). Archived from the original on 9 March 2020. Retrieved 9 March 2020.

The working week began in the City of London with oil prices down by 30% and the leading barometer of UK shares registering falls of more than 8%, so it didn't take long for it to be dubbed Crash Monday. To be sure, those with long enough memories would have been able to recall a similar market panic in October 1987, when a wave of selling began in east Asia and rolled inexorably westwards. That, though, is about as far as the comparison goes, because the 2020 Black Monday is a lot more serious than the one 30-odd years ago.

- ^ Sedensky, Matt. "Stocks, oil prices plunge as virus closes sites around world". Detroit News / Associated Press. Retrieved 9 March 2020.

"A blend of shocks have sent the markets into a frenzy on what may only be described as 'Black Monday,'" said Sebastien Clements, analyst at financial payments platform OFX. "A combination of a Russia vs. Saudi Arabia oil price war, a crash in equities, and escalations in coronavirus woes have created a killer cocktail to worsen last week's crisis."

- ^ "Stock market news live updates: Dow closes 1,167 points higher despite coronavirus worries". Yahoo! Finance. 10 March 2020. Retrieved 12 March 2020.

- ^ "Here's what happened to the stock market on Tuesday". CNBC. 10 March 2020. Retrieved 12 March 2020.

- ^ "Dow Jones Industrial Average's 11-Year Bull Run Ends". Wall Street Journal. 11 March 2020. Retrieved 12 March 2020.

- ^ "Trading halts after Dow plummets 1,696 as Trump's coronavirus response fails to calm investor nerves". Markets Insider. 12 March 2020. Retrieved 12 March 2020.