COVID-19 recession

This article contains close paraphrasing of non-free copyrighted sources. (July 2020) |

The examples and perspective in this article may not represent a worldwide view of the subject. (August 2020) |

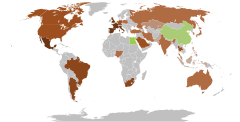

Map showing real GDP growth rates in 2020, as projected by the International Monetary Fund | |

| Date | 20 February 2020 – present (4 years, 8 months, 3 weeks and 3 days) |

|---|---|

| Type | Global recession |

| Cause | COVID-19 pandemic-induced market instability and lockdown |

| Outcome |

|

| Part of a series on the |

| COVID-19 pandemic |

|---|

|

|

|

|

The COVID-19 recession, also known as the Coronavirus Crash, the Coronavirus Recession, the Great Lockdown and the Great Shutdown,[1][2] is a major global recession which began due to the economic consequences of the ongoing COVID-19 pandemic. The first major sign of the recession was the 2020 stock market crash on 20 February, which was two months after the first case of coronavirus was confirmed in Wuhan, China.[3][4][5][6][7][8] and the International Monetary Fund (IMF) reported in 14 April that all of the G7 nations had already entered or were entering into a "deep recession" and that there had already been a significant slowdown of growth in emerging economies.[9] IMF projections suggest that this recession will be the most severe global economic downturn since the Great Depression, and that it will be "far worse" than the Great Recession of 2008–2009.[10][11][12][13]

The COVID-19 pandemic has led to more than a third of the world's population being placed on lockdown to stop the spread of COVID-19.[14] It has caused severe repercussions for economies across the world,[15] following soon after a global economic slowdown during 2019 that saw stagnation of stock markets and consumer activity worldwide.[16][17]

This recession has seen unusually high and rapid increases in unemployment in many countries, and the inability in the United States for state-funded unemployment insurance computer systems and processes to keep up with applications.[18][19] The United Nations (UN) predicted in April 2020 that global unemployment will wipe out 6.7 per cent of working hours globally in the second quarter of 2020—equivalent to 195 million full-time workers.[20] In some countries, unemployment is expected to be at around 10%, with more severely affected nations from the COVID-19 pandemic having higher unemployment rates.[21][22][23] The developing world is also being affected by a drop in remittances,[24] exacerbating the global food crisis.[25]

The recession saw a drop in the price of oil triggered by the 2020 Russia–Saudi Arabia oil price war, the collapse of tourism, the hospitality industry, the energy industry and a significant downturn in consumer activity in comparison to the previous decade.[26][27][28] Global stock markets crashed around 20 to 30% during late February and March 2020, respectively. During the crash, global stock markets made unprecedented and volatile swings, mainly due to extreme uncertainty in the markets.[29][30][31]

Background

Corporate debt bubble

Since the financial crisis of 2007–2008, there has been a large increase in corporate debt, rising from 84% of gross world product in 2009 to 92% in 2019, or about $72 trillion.[32][33] In the world's eight largest economies–China, the United States, Japan, the United Kingdom, France, Spain, Italy, and Germany–total corporate debt was about $51 trillion in 2019, compared to $34 trillion in 2009.[34] If the economic climate worsens, companies with high levels of debt run the risk of being unable to make their interest payments to lenders or refinance their debt, forcing them into restructuring.[35] The Institute of International Finance forecast in 2019 that, in an economic downturn half as severe as the 2008 crisis, $19 trillion in debt would be owed by non-financial firms without the earnings to cover the interest payments on the debt they issued.[34] The McKinsey Global Institute warned in 2018 that the greatest risks would be to emerging markets such as China, India, and Brazil, where 25–30% of bonds had been issued by high-risk companies.[36]

2019 global economic slowdown

During 2019, the IMF reported that the world economy was going through a "synchronized slowdown", which entered into its slowest pace since the Great Financial Crisis.[37] 'Cracks' were showing in the consumer market as global markets began to suffer through a 'sharp deterioration' of manufacturing activity.[38] Global growth was believed to have peaked in 2017, when the world's total industrial output began to start a sustained decline in early 2018.[39] The IMF blamed 'heightened trade and geopolitical tensions' as the main reason for the slowdown, citing Brexit and the China–United States trade war as primary reasons for slowdown in 2019, while other economists blamed liquidity issues.[37][40]

In April 2019, the U.S yield curve inverted, which sparked fears of a 2020 recession across the world.[41] The inverted yield curve and China–U.S. trade war fears prompted a sell-off in global stock markets during March 2019, which prompted more fears that a recession was imminent.[42] Rising debt levels in the European Union and the United States had always been a concern for economists. However, in 2019, that concern was heightened during the economic slowdown, and economists began warning of a 'debt bomb' occurring during the next economic crisis. Debt in 2019 was 50% higher than that during the height of the Great Financial Crisis.[43] Economists[who?] have argued that this increased debt is what led to debt defaults in economies and businesses across the world during the recession.[44][45] The first signs of trouble leading up to the collapse occurred in September 2019, when the US Federal Reserve began intervening in the role of investor to provide funds in the repo markets; the overnight repo rate spiked above an unprecedented 6% during that time, which would play a crucial factor in triggering the events that led up to the crash.[46]

China–United States trade war

The China–United States trade war occurred from 2018 to early 2020, and caused significant damage across global economies.[47] In 2018, U.S. President Donald Trump began setting tariffs and other trade barriers on China with the goal of forcing it to make changes to what the U.S. says are "unfair trade practices".[48] Among those trade practices and their effects are the growing trade deficit, the alleged theft of intellectual property, and the alleged forced transfer of American technology to China.[49]

In the United States, the trade war brought struggles for farmers and manufacturers and higher prices for consumers, which resulted in the U.S manufacturing industry entering into a "mild recession" during 2019.[50] In other countries it has also caused economic damage, including violent protests in Chile and Ecuador due to transport and energy price surges, though some countries have benefited from increased manufacturing to fill the gaps. It has also led to stock market instability. The governments of several countries, including China and the United States, have taken steps to address some of the damage caused by a deterioration in China–United States relations and tit-for-tat tariffs.[51][52][53][54] During the recession, the downturn of consumerism and manufacturing from the trade war is believed to have inflated the economic crisis.[55][56]

Brexit

In Europe, economies were hampered by the economic effects of the United Kingdom's withdrawal from the European Union, better known as Brexit. British and EU growth stagnated during 2019 leading up to Brexit, mainly due to uncertainty around the crisis.[57] The United Kingdom experienced a 'near recession' in 2019, which weakened the British economy when entering into 2020. Many businesses left the United Kingdom to move into the EU, which resulted in trade loss and economic downturn for both EU members and the UK.[58][59][60][57]

Causes

The COVID-19 pandemic is the most impactful pandemic since the Spanish flu in 1918, and the most severe pandemic since the Black Death.[61] When the pandemic first arose in late 2019 and more consequently in 2020, the world was going through economic stagnation and significant consumer downturn. Most economists believed a recession, though one which would not be particularly severe, was coming. As a result of the rapid spread of the pandemic, economies across the world initiated 'lockdowns' to curb the spread of the pandemic. This resulted in the collapse of various industries and consumerism all at once, which put major pressure on banks and employment.[62][63][64] This caused a stock market crash and, thereafter, the recession. With new social distancing measures taken in response to the pandemic, a "Great Lockdown" occurred across much of the world economy.[9]

COVID-19 pandemic

The COVID-19 pandemic is an ongoing pandemic of Coronavirus disease 2019 (COVID-19) caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2); the outbreak was identified in Wuhan, China, in December 2019, declared to be a Public Health Emergency of International Concern on 30 January 2020, and recognized as a pandemic by the World Health Organization on 11 March 2020.[65][66] The pandemic has led to severe global economic disruption,[67] the postponement or cancellation of sporting, religious, political and cultural events,[68] and widespread shortages of supplies exacerbated by panic buying.[69][70] Schools, universities and colleges have closed either on a nationwide or local basis in 63 countries, affecting approximately 47 percent of the world's student population. Many governments have restricted or advised against all non-essential travel to and from countries and areas affected by the outbreak.[71] However, the virus is already spreading within communities in large parts of the world, with many not knowing where or how they were infected.[72]

The COVID-19 pandemic has had far-reaching consequences beyond the spread of the disease and efforts to quarantine it. As the pandemic has spread around the globe, concerns have shifted from supply-side manufacturing issues to decreased business in the services sector.[73] The pandemic is considered unanimously as a major factor in causing the recession. The pandemic has affected nearly every major industry negatively, was one of the main causes of the stock market crash and has resulted in major curbings of social liberties and movement.[74][75][76][77][78]

Lockdowns

While stay-at-home orders clearly affect many types of business, especially those that provide in-person services (including retail stores, restaurants and hotels, entertainment venues and museums, medical offices, and beauty salons and spas), government orders are not the sole pressure on those businesses. In the United States, people began to change their economic behavior 10–20 days before their local governments declared stay-at-home orders,[79] and by May, changes in individuals' rates of movement (according to smartphone data) did not always correlate with local laws.[80][81][82]

Russia–Saudi Arabia oil price war

The reduction in the demand for travel and the lack of factory activity due to the COVID-19 pandemic significantly impacted demand for oil, causing its price to fall.[83] The Russian-Saudi Arabia oil price war became a cause in worsening the recession due to it crashing the price of oil. In mid-February, the International Energy Agency forecasted that oil demand growth in 2020 would be the smallest since 2011.[84] Chinese demand slump resulted in a meeting of the Organization of the Petroleum Exporting Countries (OPEC) to discuss a potential cut in production to balance the loss in demand.[85] The cartel initially made a tentative agreement to cut oil production by 1.5 million barrels per day following a meeting in Vienna on 5 March 2020, which would bring the production levels to the lowest it has been since the Iraq War.[86]

After OPEC and Russia failed to agree on oil production cuts on 6 March and Saudi Arabia and Russia both announced increases in oil production on 7 March, oil prices fell by 25 percent.[87][88] On 8 March, Saudi Arabia unexpectedly announced that it would increase production of crude oil and sell it at a discount (of $6–8 a barrel) to customers in Asia, the US, and Europe, following the breakdown of negotiations as Russia resisted calls to cut production. The biggest discounts targeted Russian oil customers in northwestern Europe.[89]

Prior to the announcement, the price of oil had gone down by more than 30% since the start of the year, and upon Saudi Arabia's announcement it dropped a further 30 percent, though later recovered somewhat.[90][91] Brent Crude, used to price two-thirds of the world's crude oil supplies, experienced the largest drop since the 1991 Gulf War on the night of 8 March. Also, the price of West Texas Intermediate fell to its lowest level since February 2016.[92] Energy expert Bob McNally noted, "This is the first time since 1930 and '31 that a massive negative demand shock has coincided with a supply shock;"[93] in that case it was the Smoot–Hawley Tariff Act precipitating a collapse in international trade during the Great Depression, coinciding with discovery of the East Texas Oil Field during the Texas oil boom. Fears of the Russian–Saudi Arabian oil price war caused a plunge in U.S. stocks, and have had a particular impact on American producers of shale oil.[94]

In early April 2020, Saudi Arabia and Russia have agreed to oil production cuts.[95][96] Reuters reported that "If Saudi Arabia failed to rein in output, US senators called on the White House to impose sanctions on Riyadh, pull out US troops from the kingdom and impose import tariffs on Saudi oil."[97] The price of oil briefly went negative on 20 April 2020.[98]

Financial crisis

The global stock market crash began on 20 February 2020, although the economic aspects of the crisis began to materialise in late 2019.[99][100][101] Due to the COVID-19 pandemic, global markets, banks and businesses were all facing crises not seen since the Great Depression in 1929.[citation needed]

From 24 to 28 February, stock markets worldwide reported their largest one-week declines since the 2008 financial crisis,[102][103][104] thus entering a correction.[105][106][107] Global markets into early March became extremely volatile, with large swings occurring in global markets.[108][109] On 9 March, most global markets reported severe contractions, mainly in response to the COVID-19 pandemic and an oil price war between Russia and the OPEC countries led by Saudi Arabia.[110][111] This became colloquially known as Black Monday I, and at the time was the worst drop since the Great Recession in 2008.[112][113]

Three days after Black Monday I there was another drop, Black Thursday, where stocks across Europe and North America fell more than 9%. Wall Street experienced its largest single-day percentage drop since Black Monday in 1987, and the FTSE MIB of the Borsa Italiana fell nearly 17%, becoming the worst-hit market during Black Thursday.[114][115][116] Despite a temporary rally on 13 March (with markets posting their best day since 2008), all three Wall Street indexes fell more than 12% when markets re-opened on 16 March.[117][118] During this time, one benchmark stock market index in all G7 countries and 14 of the G20 countries had been declared to be in Bear markets.[citation needed]

Black Monday I (9 March)

Crash

Prior to opening, the Dow Jones Industrial Average futures market experienced a 1,300-point drop based on the pandemic and fall in the oil price described above, triggering a trading curb, or circuit breaker, that caused the futures market to suspend trading for 15 minutes.[119] This predicted 1,300-point drop would establish 9 March as being among the most points the Dow Jones Industrial Average has dropped in a single day.[120][121] When the market opened on 9 March, the Dow Jones Industrial Average plummeted 1800 points on opening, 500 points lower than the prediction.[122]

The United States' Dow Jones Industrial Average lost more than 2000 points,[123] described by The News International as "the biggest ever fall in intraday trading".[124] The Dow Jones Industrial Average hit a number of trading "circuit breakers" to curb panicked selling.[119] Oil firms Chevron and ExxonMobil fell about 15%.[125] The NASDAQ Composite, also in the United States, lost over 620 points.[clarification needed] The S&P 500 fell by 7.6%.[126] Oil prices fell 22%,[127] and the yields on 10-year and 30-year U.S. Treasury securities fell below 0.40% and 1.02% respectively.[128] Canada's S&P/TSX Composite Index finished the day off by more than 10%.[129] Brazil's IBOVESPA gave up 12%, erasing over 15 months of gains for the index.[130] Australia's ASX 200 lost 7.3%—its biggest daily drop since 2008,[131][132] though it rebounded later in the day. London's FTSE 100 lost 7.7%, suffering its worst drop since the 2008 financial crisis.[133][134] BP and Shell Oil experienced intraday price drops of nearly 20%[135] The FTSE MIB, CAC 40, and DAX tanked as well, with Italy affected the most as the COVID-19 pandemic in the country continues. They fell 11.2%, 8.4%, and 7.9% respectively.[136][137][138] The STOXX Europe 600 fell to more than 20% below its peak earlier in the year.[139]

In a number of Asian markets—Japan, Singapore, the Philippines and Indonesia—shares declined over 20% from their most recent peaks, entering bear market territory.[140] In Japan, the Nikkei 225 plummeted 5.1%.[141] In Singapore, the Straits Times Index fell 6.03%.[142] In China, the CSI 300 Index lost 3%.[143] In Hong Kong, the Hang Seng index sank 4.2%.[144] In Pakistan, the PSX saw the largest ever intra-day plunge in the country's history, losing 2,302 points or 6.0%. The market closed with the KSE 100 index down 3.1%.[145] In India, the BSE SENSEX closed 1,942 points lower at 35,635 while the NSE Nifty 50 was down by 538 points to 10,451.[146]

Former George W. Bush administration energy policy advisor Bob McNally noted, "This is the first time since 1930 and '31 that a massive negative demand shock has coincided with a supply shock";[147] in the previous case it was the Smoot–Hawley Tariff Act precipitating a collapse in international trade during the Great Depression, coinciding with discovery of the East Texas Oil Field during the Texas oil boom. The Washington Post posited that pandemic-related turmoil could spark a collapse of the corporate debt bubble, sparking and worsening a recession.[148] The Central Bank of Russia announced that it would suspend foreign exchange market purchases in domestic markets for 30 days,[149] while the Central Bank of Brazil auctioned an additional $3.465 billion the foreign exchange market in two separate transactions and the Bank of Mexico increased its foreign exchange auctions program from $20 billion to $30 billion.[150][151] After announcing a $120 billion fiscal stimulus programs on 2 December,[152] Japanese Prime Minister Shinzo Abe announced additional government spending,[153] while Indonesian Finance Minister Sri Mulyani announced additional stimulus as well.[154]

Black Thursday (12 March)

Black Thursday[155] was a global stock market crash on 12 March 2020, as part of the greater 2020 stock market crash. US stock markets suffered from the greatest single-day percentage fall since the 1987 stock market crash.[156] Following Black Monday three days earlier, Black Thursday was attributed to the COVID-19 pandemic and a lack of investor confidence in US President Donald Trump after he declared a 30-day travel ban against the Schengen Area.[157] Additionally, the European Central Bank, under the lead of Christine Lagarde, decided to not cut interest rates despite market expectations,[158] leading to a drop in S&P 500 futures of more than 200 points in less than an hour.[159]

Bank Indonesia announced open market purchases of Rp4 trillion (or $276.53 million) in government bonds,[160] while Bank Indonesia Governor Perry Warjiyo stated that Bank Indonesia's open market purchases of government bonds had climbed to Rp130 trillion on the year and Rp110 trillion since the end of January.[161] Despite declining to cut its deposit rate, the European Central Bank increased its asset purchases by €120 billion (or $135 billion),[162] while the Federal Reserve announced $1.5 trillion in open market purchases.[163] Australian Prime Minister Scott Morrison announced a A$17.6 billion fiscal stimulus package.[164] The Reserve Bank of India announced that it would conduct a six-month $2 billion currency swap for U.S. dollars,[165] while the Reserve Bank of Australia announced A$8.8 billion in repurchases of government bonds.[166] The Central Bank of Brazil auctioned $1.78 billion Foreign exchange spots.[167]

Asia-Pacific stock markets closed down (with the Nikkei 225 of the Tokyo Stock Exchange, the Hang Seng Index of the Hong Kong Stock Exchange, and the IDX Composite of the Indonesia Stock Exchange falling to more than 20% below their 52-week highs),[168][169][170] European stock markets closed down 11% (with the FTSE 100 Index on the London Stock Exchange, the DAX on the Frankfurt Stock Exchange, the CAC 40 on the Euronext Paris, and the FTSE MIB on the Borsa Italiana all closing more than 20% below their most recent peaks),[171][172] while the Dow Jones Industrial Average closed down an additional 10% (eclipsing the one-day record set on 9 March), the NASDAQ Composite was down 9.4%, and the S&P 500 was down 9.5% (with the NASDAQ and S&P 500 also falling to more than 20% below their peaks), and the declines activated the trading curb at the New York Stock Exchange for the second time that week.[173][174] Oil prices dropped by 8%,[175] while the yields on 10-year and 30-year U.S. Treasury securities increased to 0.86% and 1.45% (and their yield curve finished normal).[176]

Crash

The US's Dow Jones Industrial Average and S&P 500 Index suffered from the greatest single-day percentage fall since the 1987 stock market crash, as did the UK's FTSE 100, which fell 10.87%.[177] The Canadian S&P/TSX Composite Index dropped 12%, its largest one-day drop since 1940.[178] The FTSE MIB Italian index closed with a 16.92% loss, the worst in its history.[179] Germany's DAX fell 12.24% and France's CAC 12.28%.[180] In Brazil, the Ibovespa plummeted 14.78%, after trading in the B3 was halted twice within the intraday; it also moved below the 70,000 mark before closing above it.[181][182] The NIFTY 50 on the National Stock Exchange of India fell 7.89% to more than 20% below its most recent peak, while the BSE SENSEX on the Bombay Stock Exchange fell 2,919 (or 8.18%) to 32,778.[183] The benchmark stock market index on the Johannesburg Stock Exchange fell by 9.3%.[184] The MERVAL on the Buenos Aires Stock Exchange fell 9.5% to 19.5% on the week.[185] 12 March was the second time, following 9 March, that the 7%-drop circuit breaker was triggered since being implemented in 2013.[157]

In Colombia, the peso set an all-time low against the U.S. dollar, when it traded above 4000 pesos for the first time on record.[186][187] The Mexican peso also set an all-time record low against the U.S. dollar, trading at 22.99 pesos.[188]

Black Monday II (16 March)

Over the preceding weekend, the Saudi Arabian Monetary Authority announced a $13 billion credit-line package to small and medium-sized companies,[189] while South African President Cyril Ramaphosa announced a fiscal stimulus package.[190] The Federal Reserve announced that it would cut the federal funds rate target to 0%–0.25%, lower reserve requirements to zero, and begin a $700 billion quantitative easing program.[191][192][193]

Dow futures tumbled more than 1,000 points and Standard & Poor's 500 futures dropped 5%, triggering a circuit breaker.[194] On Monday 16 March, Asia-Pacific and European stock markets closed down (with the S&P/ASX 200 setting a one-day record fall of 9.7%, collapsing 30% from the peak that was reached on 20 February).[195][196][197] The Dow Jones Industrial Average, the NASDAQ Composite, and the S&P 500 all fell by 12–13%, with the Dow eclipsing the one-day drop record set on 12 March and the trading curb being activated at the beginning of trading for the third time (after 9 and 12 March).[198] Oil prices fell by 10%,[199] while the yields on 10-year and 30-year U.S. Treasury securities fell to 0.76% and 1.38% respectively (while their yield curve remained normal for the third straight trading session).[200]

The Cboe Volatility Index closed at 82.69 on 16 March, the highest ever closing for the index (though there were higher intraday peaks in 2008).[201][202] Around noon on 16 March, the Federal Reserve Bank of New York announced that it would conduct a $500 billion repurchase through the afternoon of that day.[203] Indonesian Finance Minister Sri Mulyani announced an additional Rp22 trillion in tax-related fiscal stimulus.[204] The Central Bank of the Republic of Turkey lowered its reserve requirement from 8% to 6%.[205] The Bank of Japan announced that it would not cut its bank rate lower from minus 0.1% but that it would conduct more open market purchases of Exchange-traded funds.[206] After cutting its bank rate by 25 basis points on 7 February,[207] the Central Bank of Russia announced that it would keep its bank rate at 6%,[208] while the Bank of Korea announced that it would cut its overnight rate by 50 basis points to 0.75%.[209] The Central Bank of Chile cut its benchmark rate,[210] while the Reserve Bank of New Zealand cut its official cash rate by 75 basis points to 0.25%.[211] The Czech National Bank announced that it would cut its bank rate by 50 basis points to 1.75%.[212]

Impact by country

This section needs expansion. You can help by adding to it. (May 2020) |

Africa

In April 2020, Sub-Saharan Africa appeared poised to enter its first recession in 25 years, but this time for a longer duration.[213] The World Bank predicted that overall sub-Saharan Africa's economy would shrink by 2.1%–5.1% during 2020. [214] African countries cumulatively owe $152 billion to China from loans taken 2000–2018; as of May 2020, China was considering granting deadline extensions for repayment, and in June 2020, Chinese leader Xi Jinping said that some interest-free loans to certain countries would be forgiven.[215][216]

Botswana

Botswana has been affected by sharp falls in the diamond trade, tourism and other sectors.[217]

Egypt

The Egyptian economy is taking a heavy toll by the global recession. Tourism, which employs one in ten Egyptians and contributes about 5% of the GDP, has largely stopped, while remittances from migrant workers abroad (9% of GDP) are also expected to fall.[218] The cheap fuel prices and slower demand have also led some shipping companies to avoid the Suez Canal, and instead opt for traveling by the Cape of Good Hope, leading to reduced transit fees for the government.[218]

Ethiopia

Ethiopia is heavily dependent for export income on its national carrier, Ethiopian Airlines, which has announced suspensions on 80 flight routes.[217] Exports of flowers and other agricultural products have dropped sharply.[217]

Namibia

Namibia's central bank sees the nation's economy shrinking by 6.9%[219] This will be the biggest shrink of GDP since its independence in 1990. The tourism and hospitality industries has accounted for N$26 billion being lost as 125 000 jobs have been affected.[220] The central bank also announced that the diamond-mining sector will decline by 14.9% in 2020, while uranium mining may shrink 22%.[219]

Zambia

Zambia is facing a severe debt crisis.[221] Almost half the national budget goes towards interest payments, with questions about whether the country will be able to make all future payments.[221]

Americas

Argentina

Argentina entered its 9th sovereign default in history due to the recession.[222] The government has proposed taking over one of the largest agroexporting companies Vicentín S.A.I.C after it incurred in a debt of more than $1.35 billion.[223]

Belize

The fall in travel is expected to drive Belize into a deep recession in 2020.[217]

Brazil

The Brazilian government forecast that its economy will experience its biggest crash since 1900, with a gross domestic product contraction of 4.7%.[224] At the first trimester of 2020 the gross domestic product was 1.5% smaller than the GDP of the first trimester of 2019, and it decreased to the same level of 2012.[225] On 9 April 2020, at least 600,000 businesses went bankrupt, and 9 million people were fired.[226]

Canada

By June 2020, the national unemployment rate in Canada was 12.5%, down from 13.7% in May.[227]

Total unemployment increased by 3 million and total hours worked fell by 30% between February and April 2020. Canadian manufacturing sales in March fell to the lowest level since mid-2016, as sales by auto manufacturers and parts suppliers plunged more than 30%.[228]

In response, the Government of Canada introduced several benefits including, the Canada Emergency Response Benefit, the Canada Emergency Student Benefit, and the Canada Emergency Wage Subsidy.[229]

Mexico

Mexico's outlook was already poor before the crisis, with a mild recession in 2019.[230] The economic development plans of president Andrés Manuel López Obrador were predicated on revenue from the state oil company Pemex, but the oil price collapse has now raised doubts on those plans.[230] Beyond oil, the country's economy also relies on tourism, trade with the United States, as well as remittances, which all are also being affected.[231] All of this leading to what could be Mexico's worst recession in a century, and the worst in Latin America after Venezuela.[231]

United States

Before the pandemic, there were signs of recession. The US yield curve inverted in mid-2019, usually indicative of a forthcoming recession.[232][233]

Starting in March 2020, job loss was rapid. About 16 million jobs were lost in the United States in the three weeks ending on 4 April.[234] Unemployment claims reached a record high, with 3.3 million claims made in the week ending on 21 March. (The previous record had been 700,000 from 1982.)[235][236] On 8 May, the Bureau of Labor Statistics reported a U-3 unemployment (official unemployment) figure of 14.7%, the highest level recorded since 1941, with U-6 unemployment (total unemployed plus marginally attached and part-time underemployed workers) reaching 22.8%.[237]

Restaurant patronage fell sharply across the country,[238] and major airlines reduced their operations on a large scale.[239] The Big Three car manufacturers all halted production.[240] In April, construction of new homes dropped by 30%, reaching the lowest level in five years.[241]

Approximately 5.4 million Americans lost their health insurance from February to May 2020 after losing their jobs.[242][243]

The St. Louis Fed Financial Stress Index increased sharply from below zero to 5.8 during March 2020.[244][245] The United States Department of Commerce reported that consumer spending fell by 7.5 percent during the month of March 2020. It was the largest monthly drop since record keeping began in 1959. As a result, the country's gross domestic product reduced at a rate of 4.8 percent during the first quarter of 2020.[246]

The largest economic stimulus legislation in American history, a $2 trillion package called the CARES Act, was signed into law on 27 March 2020.[247]

The Congressional Budget Office reported in May 2020 that:

- The unemployment rate increased from 3.5% in February to 14.7% in April, representing a decline of more than 25 million people employed, plus another 8 million persons that exited the labor force.

- Job declines were focused on industries that rely on "in-person interactions" such as retail, education, health services, leisure and hospitality. For example, 8 of the 17 million leisure and hospitality jobs were lost in March and April.

- The economic impact was expected to hit smaller and newer businesses harder, as they typically have less financial cushion.

- Real (inflation-adjusted) consumer spending fell 17% from February to April, as social distancing reached its peak. In April, car and light truck sales were 49% below the late 2019 monthly average. Mortgage applications fell 30% in April 2020 versus April 2019.

- Real GDP was forecast to fall at a nearly 38% annual rate in the second quarter, or 11.2% versus the prior quarter, with a return to positive quarter-to-quarter growth of 5.0% in Q3 and 2.5% in Q4 2020. However, real GDP was not expected to regain its Q4 2019 level until 2022 or later.

- The unemployment rate was forecast to average 11.5% in 2020 and 9.3% in 2021.[248]

In June 2020, economic analyst Jim Cramer said that the response to the COVID-19 recession has led to the biggest transfer of wealth to the ultra-wealthy in modern history.[249] On 30 July 2020, it was reported that the U.S. 2nd quarter gross domestic product fell at an annualized rate of 33%.[250]

Latin America

The recession caused by COVID-19 is expected to be the worst in the history of Latin America.[251] Latin American countries are expected to fall into a "lost decade", with Latin America's GDP returning to 2010 levels, falling by 9.1%. The amount by which the GDP is expected to fall per country is listed below[252]

| Country | GDP contraction |

|---|---|

| Venezuela | -26% |

| Peru | -13% |

| Brazil | -10.5% |

| Argentina | -9.2% |

| Ecuador | -9% |

| Mexico | -9% |

| El Salvador | -8.6% |

| Nicaragua | -8.3% |

| Cuba | -8% |

| Chile | -7.9% |

| Panama | -6.5% |

| Honduras | -6.1% |

| Colombia | -5.6% |

| Costa Rica | -5.5% |

| Dominican Republic | -5.3% |

| Bolivia | -5.2% |

| Uruguay | -5% |

| Guatemala | -4.1% |

| Paraguay | -2.3% |

Other sources may expect different figures.[253][254][255][256] In Panama, COVID-19 is expected to subtract US$5.8 billion from Panama's GDP.[257] Aiding Chile's downfall is reduced demand for copper from the US and China due to COVID-19.[252]

Asia–Pacific

Australia

Australia before the recession was suffering from an unusually severe and expensive bushfire season which damaged the economy and domestic trade routes.[258] Not only that, but Australia had experienced significant slowdown in their economic growth, with economists in late 2019 saying that Australia was 'teetering on the edge of a recession'.[259] As a result of this and the effects of the recession, Australia is expecting a deep recession with at least 10.0% of the able working population becoming unemployed according to the Australian treasury and at least a 6.7% GDP retraction according to the IMF.[260][261] In April 2020, a water consultant predicted a shortage of rice and other staples during the pandemic unless farmers' water allocations were changed.[262]

The unemployment level of 5.1% is projected to rise to a 25-year high of 10.0%, according to Treasury data released in April 2020.[263][264] The Jobseeker Allowance unemployment benefit was doubled in April, but Prime Minister Scott Morrison said that this would likely be reduced when the pandemic ends.[265]

As of April 2020, up to a million people have been laid off due to effects of the recession.[266] Over 280,000 individuals applied for unemployment support at the peak day.[267]

On 23 July 2020, Josh Frydenberg delivered a quarterly budget update stating the government had implemented a $289 billion economic support package. As a result, the 2020-21 budget will record a $184 billion deficit, the largest since WWII. Australia will maintain their triple A credit rating. Net debt will increase to $677.1 billion at 20 June 2021. Further, real GDP is forecast to have fallen sharply by 7% in the June quarter with unemployment anticipated to peak at 9.25% in the December quarter. However, due to the further reinstatement of restrictions on Victoria, notably stage 4 restrictions, national unemployment is now set to reach 11%. The 2020-21 Budget will be handed down on October 6, delayed from May.[268] Treasury estimates now place Australia on track to experience a depression, with Australia experiencing a 0.25% contraction in GDP in the 2019-20 financial year, and predictions now expecting a greater than 2.5% contraction in the financial year of 2020–21.[269]

Bangladesh

The Bangladeshi economy is heavily dependent on the garment industry and remittances from migrant workers.[270] The garment industry has been heavily affected, having already been contracting in 2019.[270] Remittances in turn are expected to fall 22 percent.[270]

China

As a result of the recession, China's economy contracted for the first time in almost 50 years.[271] The national GDP for the first quarter of 2020 dropped 6.8% year-on-year, 9.8% quarter on quarter, and the GDP for Hubei Province dropped 39.2% in the same period.[272]

In May 2020, Chinese Premier Li Keqiang announced that, for the first time in history, the central government would not set an economic growth target for 2020, with the economy having contracted by 6.8% compared to 2019 and China facing an "unpredictable" time. However, the government also stated an intention to create 9 million new urban jobs until the end of 2020.[273]

In late January, economists predicted a V-shaped recovery. By March, it was much more uncertain.[274]

Fiji

On 18 March, the Reserve Bank of Fiji reduced its overnight policy rate (OPR)[a] and predicted the domestic economy to fall into a recession after decades of economic growth.[275] Later on 25 June, the national bank predicted the Fijian economy to contract severely this year due to falling consumption and investment associated with ongoing job-losses.[276] Annual inflation remained in negative territory in May (-1.7%) and is forecast to edge up to 1.0 percent by year-end.[277]

- ^ The OPR is the key interest rate used by the Reserve Bank of Fiji (RBF) to officially indicate and communicate its monetary policy stance. A reduction in the OPR signifies an easing of monetary policy.

India

The IMF predicted the growth rate of India in the financial year of 2020–21 as 1.9%,[278] but in the following financial year, they predict it to be 7.4%.[279] IMF also predicted that India and China are the only two major economies that will maintain positive growth rates.[280]

On 24 June 2020 IMF revised India's growth rate to -4.5%, a historic low. However, IMF said India's economy is expected to bounce back in 2021 with a robust six percent growth rate.

On 31 August 2020, the National Statistical Office (NSO) released the data, which revealed that the country’s GDP contracted by 23.9 per cent in the first quarter of 2020-2021 financial year. The economic contraction followed the severe lockdown to contain the COVID-19 pandemic, where an estimated 140 million jobs were lost. According to the Organisation for Economic Co-operation and Development, it was the worst fall in history. [281]

Iraq

As 90% of the government income comes from oil, it will be extremely heavily hit by the drop in prices.[230]

Japan

In Japan, the 2019 4th quarter GDP shrank 7.1% from the previous quarter[282] due to two main factors. One is the government's raise in consumption tax from 8% to 10% despite opposition from the citizens. The other is the devastating effects of Typhoon Hagibis, also known as the Reiwa 1 East Japan Typhoon (令和元年東日本台風, Reiwa Gannen Higashi-Nihon Taifū), or Typhoon Number 19 (台風19). The 38th depression, 9th typhoon and 3rd super typhoon of the 2019 Pacific typhoon season, it was the strongest typhoon in decades to strike mainland Japan, and one of the largest typhoons ever recorded at a peak diameter of 825 nautical miles (950 mi; 1529 km). It was also the costliest Pacific typhoon on record, surpassing Typhoon Mireille's record by more than US$5 billion (when not adjusted for inflation).[283] In the resort town of Hakone, record rainfall of almost a meter (942.3 mm, 37.1 inches) fell in only 24 hours.[284] This adds to the effect of the pandemic on people's lives and the economy, the prime minister unveiling a 'massive" stimulus amounting to 20% of GDP.[285]

Lebanon

Since August 2019, Lebanon had been experiencing a major economic crisis that was caused by an increase in the official exchange rate between the Lebanese pound and the United States dollar.[286][287]

Nepal

As millions of Nepalis work outside of the country, at least hundreds of thousands are expected to return due to layoffs abroad, in what has been labelled a "crisis" that may "overwhelm the Nepali state".[288]

New Zealand

The New Zealand Treasury projected that the country could experience an unemployment rate of 13.5% if the country remains in lockdown for four weeks. Finance Minister Grant Robertson has vowed that the Government will keep the unemployment rate below 10%. Prior to lockdown, the unemployment rate was at 4.2% [289][290][291]

BNZ economists are predicting a 12% fall in property prices and an even larger decline in the construction of new homes. GDP contracted 1.6% in the first quarter of 2020[292][293]

Philippines

The Philippines' real GDP contracted by 0.2% in the first quarter of 2020, the first contraction since the fourth quarter of 1998, a year after the Asian financial crisis.[294] The economy slipped in technical recession after a 16.5% decline was recorded in the second quarter.[295]

The government projects that the GDP will contract by 5.5% in 2020. The First Metro Investment Corp projects a year-on-year GDP decline of 8-9%. The decline is led by a decrease in household spending which typically accounts for 70% of the country's GDP and hesitancy on spending due to COVID-19 community quarantine measures.[296]

Singapore

Property investment sales in Singapore fell 37 per cent to $3.02 billion in the first quarter of this year from the previous three months as the pandemic took its toll on investor sentiment, a report from Cushman & Wakefield on 13 April showed.[297]

On 28 April, the Monetary Authority of Singapore (MAS) said in its latest half-yearly macroeconomic review Singapore will enter into a recession this year because of the blow from the COVID-19 pandemic, resulting in job losses and lower wages, with "significant uncertainty" over how long and intense the downturn will be. Depending on how the pandemic evolves and the efficacy of policy responses around the world, Singapore's economic growth could even dip below the forecast range of minus four to minus one per cent to record its worst-ever contraction.[298]

On 29 April, the Ministry of Manpower (MOM) said that total employment excluding foreign domestic workers dropped by 19,900 in the first three months of the year, mainly due to a significant reduction in foreign employment. Among Singapore citizens, the unemployment rate increased from 3.3 per cent to 3.5 per cent, while the resident unemployment rate, which includes permanent residents, increased from 3.2 per cent to 3.3 per cent.[299]

On 14 May, Singapore Airlines (SIA) posted its first annual net loss in 48 years - a net loss of S$732.4 million in the fourth quarter, reversing from a net profit of S$202.6 million in the corresponding quarter a year ago.[300]

Europe

The European Purchasing Managers' Index, a key indicator of economic activity, crashed to a record-low of 13.5 in April 2020.[301] Normally, any figure below 50 is a sign of economic decline.[301]

Belarus

The Belarusian economy is being negatively affected by the loss of Russian oil subsidies, and the drop in price of Belarus's refined oil products.[217]

France

France's yellow vest movement caused significant economic damage to the French economy in 2019, alongside a global slowdown.[302][303] France has been significantly hit hard by the pandemic, with two months of 'strict lockdown' imposed on the French society.[304] On 8 April 2020, the Bank of France officially declared that the French economy was in recession, shrinking by 6 percent in the first quarter of 2020.[305]

At the end of the second trimester of 2020, several companies initiated social plans with important staff cuts in France: Nokia (1233 jobs),[306] Renault (4600 jobs),[307] Air France (7580 jobs),[307] Airbus (5000 jobs),[307] Derichebourg (700 jobs),[308] TUI France (583 jobs)[309] and NextRadio TV (330-380 jobs).[309]

Germany

Minister of Finance of Hesse, Thomas Schäfer, was found dead on 28 March 2020. Schäfer left a suicide note, where he mentions the "hopeless" economic situation in the country as one of the reasons.[310]

Italy

Italy's unemployment rate is expected to rise to 11.2%, with 51% fearing unemployment in March.[311][312]

The preliminary estimate of 1Q20 Italian GDP shows a 4.7% quarter on quarter fall (-4.8% YoY), a much steeper decline than in any quarter seen either during the financial crisis or the sovereign debt crisis.[313]

United Kingdom

On 19 March 2020 the Bank of England cut the interest rate to a historic low of 0.1%.[314] Quantitative easing was extended by £200 billion to a total of £645 billion since the start of the Great Recession.[315] A day later, the Chancellor of the Exchequer Rishi Sunak announced the government would spend £350 billion to bolster the economy.[316] On 24 March non-essential business and travel were officially banned in the UK to limit the spread of SARS-CoV-2.[317] In April the Bank agreed to extend the government's overdraft facility from £370 million to an undisclosed amount for the first time since 2008.[318] Household spending fell 41.2% in April 2020 compared with April 2019.[319] April's Purchasing Managers' Index score was 13.8 points, the lowest since records began in 1996, indicating a severe downturn of business activity.[320]

By the start of May, 23% of the British workforce had been furloughed (temporarily laid off). Government schemes were launched to help furloughed employees and self-employed workers whose incomes had been affected by the outbreak, effectively paying 80% of their regular incomes, subject to eligibility.[321] The Bank estimated that the UK economy could shrink 30% in the first half of 2020 and that unemployment was likely to rise to 9% in 2021.[322] Economic growth was already weak before the crisis, with 0% growth in the fourth quarter of 2019.[323] On 13 May, the Office for National Statistics announced a 2% fall in GDP in the first quarter of 2020, including a then-record 5.8% monthly fall in March. The Chancellor warned it was very likely the UK was going through a significant recession.[324]

HSBC, which is based in London, reported $4.3 billion in pre-tax profits during the first half of 2020; this was only one-third of the profits it had taken in the first half of the previous year.[325]

On 12 August, it was announced that the UK had entered into recession for the first time in 11 years.[326]

Summary of national impacts

| Region | Effect on annual GDP (%) | Unemployment (%) |

|---|---|---|

| Australia | -7.0 | 6.2 |

| Austria | -6.0 | 4.5 |

| Argentina | -6.7 | 8.9 |

| Belgium | -6.3 | 5.2 |

| Brazil | -5.5 | 11.6 |

| Canada | -3.2 | 13.0 |

| Chile | -4.9 | 7.8 |

| Colombia | -2.7 | 12.2 |

| Denmark | -4.5 | 4.1 |

| Eurozone | -5.9 | 7.3 |

| France | -5.3 | 8.1 |

| Germany | -6.0 | 3.2 |

| Greece | -6.0 | 16.4 |

| Hong Kong | -2.3 | 6.2 |

| Israel | -2.3 | 3.4 |

| Italy | -7.0 | 9.7 |

| Japan | -1.6 | 2.4 |

| Malaysia | -1.0 | 3.3 |

| Mexico | -6.5 | 3.7 |

| Netherlands | -7.0 | 3.8 |

| Norway | -6.0 | 3.8 |

| Peru | -2.5 | 7.6 |

| Russia | -2.6 | 4.6 |

| Saudi Arabia | -3.0 | 5.7 |

| Singapore | -3.2 | 2.3 |

| South Africa | -4.0 | 29.1 |

| South Korea | -1.8 | 4.2 |

| Spain | -6.0 | 13.6 |

| Sweden | -2.3 | 7.1 |

| Taiwan | -1.9 | 3.8 |

| Thailand | -5.9 | 1.1 |

| Turkey | -3.5 | 13.8 |

| United Kingdom | -4.7 | 4.0 |

| United States | -2.9 | 14.7 |

Impact by sector

Various service sectors are expected to be hit especially hard by the COVID-19 recession.[328]

Automotive industry

New vehicle sales in the United States have declined by 40%.[329] The American Big Three have all shut down their US factories.[330] The German automotive industry is coming into the crisis after having already suffered from the Dieselgate-scandal, as well as competition from electric cars.[331]

Energy

The demand shock to oil was so severe that the price of American oil futures contracts became negative (bottoming out at $-37.63 per barrel on the West Texas Intermediate), as traders started paying for buyers to take the product before storage capacity ran out.[332] This was despite an earlier OPEC+ deal which cut world production by 10% and ended the 2020 Russia–Saudi Arabia oil price war.[333]

Tourism

The global tourism industry may shrink up to 50% due to the pandemic.[334]

Restaurants

The COVID-19 pandemic has impacted the restaurant business. In the beginning of March 2020, some major cities in the US announced that bars and restaurants would be closed to sit-down diners and limited to takeout orders and delivery.[335] Some employees were fired, and more employees lacked sick leave in the sector compared to similar sectors.[336][337]

Retail

Shopping centers and other retailers around the world have reduced hours or closed down entirely. Many were expected not to recover, thereby accelerating the effects of the retail apocalypse.[338] Department stores and clothing shops have been especially hit.[338]

Transportation

This section focuses only on one specialized aspect of the subject. (March 2020) |

The pandemic has had a significant impact on the aviation industry due to the resulting travel restrictions as well as slump in demand among travelers. Significant reductions in passenger numbers have resulted in planes flying empty between airports and the cancellation of flights.[citation needed]

The following airlines have gone bankrupt or into administration:

- Compass Airlines[339]

- Flybe[339]

- Trans States Airlines[339]

- Virgin Australia[340]

- Air Mauritius[341]

- Avianca

The cruise ship industry has also been heavily affected by a downturn, with the share prices of the major cruise lines down 70–80%.[342]

U.S Impact by occupation and demographic

Differences across occupations caused difference in the economic effects across groups. Certain jobs were less suitable for remote work, e.g. because they involve working with people closely or with particular materials. Women tended to be affected more than men.[343] The employment of immigrants in the U.S. declined more than for the native-born partly because the kinds of job immigrants held.[344]

Impact of U.S. protests

The economic impact of the protests in the U.S. has exacerbated the COVID-19 recession by sharply curtailing consumer confidence, straining local businesses, and overwhelming public infrastructure with large-scale property damage,[345] costing an estimated $500 million.[346] A number of small businesses, already suffering from the economic impact of the COVID-19 pandemic, were harmed by vandalism, property destruction, and looting.[347][348] Curfews instated by local governments – in response to both the pandemic and protests – have also "restricted access to the downtown [areas]" to essential workers, lowering economic output.[345]

The U.S. stock market has remained unaffected or otherwise increased since the start of the protests on 26 May.[349] The protest's first fortnight coincided with a 38% rise in the stock market.[350] A resurgence of COVID-19 (facilitated by mass protests) could exacerbate the 2020 stock market crash according to Canadian economists at RBC.[351] The protests have disrupted national supply chains over uncertainty regarding public safety, a resurgence of COVID-19, and consumer confidence. A number of Fortune 500 companies, with large distribution networks, have scaled back deliveries and shuttered stores in high-impact areas.[345] Mass demonstrations, of both peaceful and violent varieties, has been linked to diminished consumer confidence and demand stemming from the public health risks of group gatherings amid COVID-19.[345]

Large-scale property damage stemming from the protests has led to increased insurance claims, bankruptcies, and curbed economic activity among small businesses and state governments. Insurance claims arising from property damage suffered in rioting is still being assessed, but is thought to be significant, perhaps record-breaking.[352]

Public financing and funding, particularly on the state level, has also been impacted by the protests. The COVID-19 recession has eroded large parts of state budgets which have, subsequently, struggled to finance the police overtime pay, security costs, and infrastructure repairs related to the demonstrations.[345] State governments have, since June, announced budget cuts to police departments as well as increased funding to other public safety measures.[353]

Food insecurity

Unlike the Great Recession, it is expected that the COVID-19 recession will also affect the majority of developing nations. On 21 April, the United Nations World Food Programme warned that a famine "of biblical proportions" was expected in several parts of the world as a result of the pandemic.[354][355] The release of 2020 Global Report on Food Crises indicated that 55 countries were at risk,[356] with David Beasley estimating that in a worst-case scenario "about three dozen" countries would succumb to famine.[355][357] This is particularly an issue in several countries affected by war, including the Yemeni Civil War, the Syrian Civil War, insurgency in the Maghreb and the Afghanistan Conflict and occurs on a background of the 2019 locust infestations in East Africa. Nestlé, PepsiCo, the United Nations Foundation and farmers' unions have written to the G20 for support in maintaining food distributions in order to prevent food shortages.[358] It is estimated that double the number of people "will go hungry" when compared to pre-pandemic levels.[358]

The United Nations forecasts that the following member states will have significant areas with poor food security categorised as under "stress" (IPC phase 2), "crisis" (IPC phase 3), "emergency" (IPC phase 4) or "critical emergency" (IPC phase 5) in 2020:[356]

Afghanistan

Afghanistan Angola

Angola Burkina Faso

Burkina Faso Cabo Verde

Cabo Verde Cameroon

Cameroon CAR

CAR Chad

Chad Cote d'Ivoire

Cote d'Ivoire DR Congo

DR Congo El Salvador

El Salvador Eswatini

Eswatini Ethiopia

Ethiopia Gambia

Gambia Guatemala

Guatemala Guinea

Guinea Guinea-Bissau

Guinea-Bissau Haiti

Haiti Honduras

Honduras Iraq

Iraq Kenya

Kenya Lesotho

Lesotho Liberia

Liberia Libya

Libya Madagascar

Madagascar Malawi

Malawi Mali

Mali Mauritania

Mauritania Mozambique

Mozambique Myanmar

Myanmar Namibia

Namibia Nicaragua

Nicaragua Niger

Niger Nigeria

Nigeria Pakistan

Pakistan Rwanda

Rwanda Senegal

Senegal Sierra Leone

Sierra Leone Somalia

Somalia South Sudan

South Sudan Sudan

Sudan Syria

Syria Uganda

Uganda Tanzania

Tanzania Venezuela

Venezuela Yemen

Yemen Zambia

Zambia Zimbabwe

Zimbabwe

It also raises alerts around:[356]

Bangladesh, in Cox's Bazar

Bangladesh, in Cox's Bazar Colombia, amongst Venezuelan migrants

Colombia, amongst Venezuelan migrants Djibouti

Djibouti Ecuador, amongst Venezuelan migrants

Ecuador, amongst Venezuelan migrants Lebanon, amongst Syrian refugees

Lebanon, amongst Syrian refugees Palestine

Palestine Turkey, amongst Syrian refugees

Turkey, amongst Syrian refugees Ukraine, in the Luhansk and Donetsk oblasts:

Ukraine, in the Luhansk and Donetsk oblasts:

Donetsk People's Republic (not recognised by the UN)

Donetsk People's Republic (not recognised by the UN) Luhansk People's Republic (not recognised by the UN)

Luhansk People's Republic (not recognised by the UN)

On 9 July, Oxfam released a report warning that "12,000 people per day could die from COVID-19 linked hunger" by 2021, estimating an additional 125 million people are at risk of starvation due to the pandemic.[359][360] In particular the report highlighted "emerging epicentres" of hunger, alongside famine-stricken areas, including areas in Brazil, India, Yemen and the Sahel.[360]

National fiscal responses

Several countries have announced stimulus programs to counter the effects of the recession. Below is a summary table based on data from the International Monetary Fund (unless otherwise specified).[217]

| Country | Direct spending (billions US$) | Direct spending (% GDP) | Loan guarantees and asset purchases (billions US$) | Notes | Additional sources |

|---|---|---|---|---|---|

| 139 | 9.7 | 125 | |||

| 43 | 9 | ||||

| 1.9 | 4.1 | ||||

| 1.5 | 4.2 | 9.8 | |||

| 11.4 | 2.3 | 51.9 | |||

| 145 | 8.4 | 170 | |||

| 11.75 | 4.7 | ||||

| 380 | 2.5 | 770 | |||

| 1.00 | 4.3 | ||||

| 4 | 2 | 40 | |||

| 9 | 2.5 | Another 2.5% is estimated to come from automatic stabilizers. | |||

| 6.13 | 1.8 | ||||

| 2 | 7 | ||||

| 600 | 4 | 870 | Not including individual action by states. | ||

| 129 | 5 | 300 | |||

| 175 | 4.9 | 825 | States have announced additional spending. | ||

| 27 | 14 | ||||

| 36.69 | 10 | ||||

| 267 | 9 | ||||

| 55 | 10+ | ||||

| 14.9 | 4 | ||||

| 26 | 7.2 | 10 | |||

| 90 | 3.1 | 400 | |||

| 1,070 | 21.1 | 15 | |||

| 13 | 9 | ||||

| 3.5 | 4.9 | ||||

| 6.6 | 12.1 | ||||

| 7.5 | 2.1 | 10 | |||

| 40.9 | 21 | ||||

| 18 | 5.5 | ||||

| 8.8 | 3.8 | Provincial governments have also announced fiscal measures | |||

| 20 | 8 | announced expenditure of 12% from total GDP | |||

| 20.6 | 13 | ||||

| 72.7 | 4.3 | Total of the recovery plan in 2020–2021. | [361] | ||

| 3.35 | 6.5 | Assistance in total amounts to about 5.7 billions USD (11% of the total GDP) | [362] | ||

| 14 | 0.6 | 90 | |||

| 54.5 | 11 | ||||

| 73 | 10.4 | ||||

| 480 | 9.6 | ||||

| 20 | 2 | ||||

| 7.22 | 2 | ||||

| 2900 | 14.5 | 4000 |

See also

- Economic impact of the COVID-19 pandemic

- Impact of the COVID-19 pandemic on the environment#Investments and other economic measures

References

- ^ Wolf, Martin (14 April 2020). "The world economy is now collapsing". Financial Times. Retrieved 15 April 2020.

- ^ "World Economic Outlook, April 2020: The Great Lockdown". IMF.

- ^ Islam, Faisal (20 March 2020). "Coronavirus recession not yet a depression". BBC News. Retrieved 16 April 2020.

- ^ Hawkins, John. "How will the coronavirus recession compare with the worst in Australia's history?". The Conversation. Retrieved 16 April 2020.

- ^ Stewart, Emily (21 March 2020). "The coronavirus recession is already here". Vox. Retrieved 16 April 2020.

- ^ Islam, Faisal (20 March 2020). "Coronavirus recession not yet a depression". BBC News. Retrieved 26 March 2020.

- ^ "The coronavirus recession has arrived". The Canberra Times. 25 March 2020. Retrieved 26 March 2020.

- ^ Elliott, Larry (14 April 2020). "'Great Lockdown' to rival Great Depression with 3% hit to global economy, says IMF". The Guardian. ISSN 0261-3077. Retrieved 15 April 2020.

- ^ a b "The Great Lockdown: Worst Economic Downturn Since the Great Depression". IMF Blog. Retrieved 16 April 2020.

- ^ "The Great Recession Was Bad. The 'Great Lockdown' Is Worse". BloombergQuint. Retrieved 15 April 2020.

- ^ "IMF Says 'Great Lockdown' Worst Recession Since Depression, Far Worse Than Last Crisis". nysscpa.org. Retrieved 15 April 2020.

- ^ Winck, Ben (14 April 2020). "IMF economic outlook: 'Great Lockdown' will be worst recession in century". Business Insider. Retrieved 27 April 2020.

- ^ Larry Elliott Economics editor. "'Great Lockdown' to rival Great Depression with 3% hit to global economy, says IMF | Business". The Guardian. Retrieved 27 April 2020.

{{cite web}}:|author=has generic name (help) - ^ McFall-Johnsen, Juliana Kaplan, Lauren Frias, Morgan (14 March 2020). "A third of the global population is on coronavirus lockdown – here's our constantly updated list of countries and restrictions". Business Insider Australia. Retrieved 15 April 2020.

{{cite web}}: CS1 maint: multiple names: authors list (link) - ^ "World Economic Outlook, April 2020 : The Great Lockdown". IMF. Retrieved 15 April 2020.

- ^ Elliott, Larry (8 October 2019). "Nations must unite to halt global economic slowdown, says new IMF head". The Guardian. ISSN 0261-3077. Retrieved 15 April 2020.

- ^ Cox, Jeff (21 November 2019). "The worst of the global economic slowdown may be in the past, Goldman says". CNBC. Retrieved 15 April 2020.

- ^ Aratani, Lauren (15 April 2020). "'Designed for us to fail': Floridians upset as unemployment system melts down". The Guardian. ISSN 0261-3077. Retrieved 15 April 2020.

- ^ "The coronavirus has destroyed the job market. See which states have been hit the hardest". NBC News. Retrieved 15 April 2020.

- ^ "ILO: COVID-19 causes devastating losses in working hours and employment". 7 April 2020. Retrieved 19 April 2020.

- ^ Partington, Richard (14 April 2020). "UK economy could shrink by 35% with 2m job losses, warns OBR". The Guardian. ISSN 0261-3077. Retrieved 15 April 2020.

- ^ Sullivan, Kath (13 April 2020). "Unemployment forecast to soar to highest rate in almost 30 years". ABC News. Retrieved 15 April 2020.

- ^ Amaro, Silvia (15 April 2020). "Spain's jobless rate is set to surge much more than in countries like Italy". CNBC. Retrieved 15 April 2020.

- ^ "Covid stops many migrants sending money home". The Economist. ISSN 0013-0613. Retrieved 23 April 2020.

- ^ Picheta, Rob. "Coronavirus pandemic will cause global famines of 'biblical proportions,' UN warns". CNN. Retrieved 13 July 2020.

- ^ Yergin, Daniel (7 April 2020). "The Oil Collapse". ISSN 0015-7120. Retrieved 15 April 2020.

- ^ Dan, Avi. "Consumer Attitudes And Behavior Will Change in the Recession, And Persist When It Ends". Forbes. Retrieved 15 April 2020.

- ^ "The $1.5 Trillion Global Tourism Industry Faces $450 Billion Collapse in Revenues, Based on Optimistic Assumptions". Wolf Street. 30 March 2020. Retrieved 15 April 2020.

- ^ Williams, Sean (10 March 2020). "Stock Market Crash 2020: Everything You Need to Know". The Motley Fool. Retrieved 15 April 2020.

- ^ DeCambre, Mark. "Wild stock-market swings are 'emotionally and intellectually wearing' on Wall Street". MarketWatch. Retrieved 15 April 2020.

- ^ Samuelson, Robert J. "Opinion | What the Crash of 2020 means". The Washington Post. Retrieved 15 April 2020.

- ^ "Corporate bonds and loans are at the centre of a new financial scare". The Economist. 12 March 2020. Retrieved 12 April 2020.

- ^ "April 2020 Global Debt Monitor: COVID-19 Lights a Fuse". Institute of International Finance. 7 April 2020. Retrieved 12 April 2020.

- ^ a b "Transcript of October 2019 Global Financial Stability Report Press Briefing". International Monetary Fund. 16 October 2019. Retrieved 12 April 2020.

- ^ Alster, Norm (16 April 2020). "Companies With High Debt Are Paying a Price". The New York Times. Retrieved 16 April 2020.

- ^ Lund, Susan (21 June 2018). "Are we in a corporate debt bubble?". McKinsey Global Institute. Retrieved 11 March 2020.

- ^ a b "The World Economy: Synchronized Slowdown, Precarious Outlook". IMF Blog. Retrieved 15 April 2020.

- ^ Gurdus, Lizzy (10 October 2019). "'Yellow flag on recession risk': Top forecaster warns of cracks in consumer spending". CNBC. Retrieved 15 April 2020.

- ^ Achuthan, Lakshman; Banerji, Anirvan. "Opinion: Here's what is really causing the global economic slowdown". CNN. Retrieved 15 April 2020.

- ^ Barone, Robert. "A Strange New World: Economic Slowdown, Liquidity Issues". Forbes. Retrieved 15 April 2020.

- ^ Chappelow, Jim. "Inverted Yield Curve Definition". Investopedia. Retrieved 15 April 2020.

- ^ DeCambre, Mark. "Dow, S&P 500 set for worst May tumble in nearly 50 years amid U.S.-China trade clash". MarketWatch. Retrieved 15 April 2020.

- ^ Robertson, Andrew (12 September 2019). "'How'd you go broke? Slow and then very fast': Economists warn on debt". ABC News. Retrieved 15 April 2020.

- ^ "Household debt up 7.4% in 2019 amid economic woes". Bangkok Post. Retrieved 15 April 2020.

- ^ Lee, Yen Nee (15 April 2020). "Coronavirus could cause more countries to default on their debt, economist says". CNBC. Retrieved 15 April 2020.

- ^ "Statement Regarding Monetary Policy Implementation". Federal Reserve. 11 October 2019.

- ^ Casselman, Ben; Chokshi, Niraj; Tankersley, Jim (22 January 2020). "The Trade War, Paused for Now, Is Still Wreaking Damage". The New York Times. ISSN 0362-4331. Retrieved 15 April 2020.

- ^ Swanson, Ana (5 July 2018). "Trump's Trade War With China Is Officially Underway". The New York Times. ISSN 0362-4331. Retrieved 15 April 2020.

- ^ "Findings of the Investigation into China's Acts, Policies, and Practices Related to Technology Transfer, Intellectual Property, and Innovation Under Section 301 of the Trade Act of 1974" (PDF). Office of the U.S. Trade Representative. Retrieved 15 April 2020.

- ^ Long, Heather; Van Dam, Andrew. "U.S. manufacturing was in a mild recession during 2019, a sore spot for the economy". The Washington Post. Retrieved 15 April 2020.

- ^ "China–US trade war: Sino-American ties being torn down brick by brick". Al Jazeera. Retrieved 18 August 2019.

- ^ "For the U.S. and China, it's not a trade war anymore – it's something worse". Los Angeles Times. 31 May 2019. Retrieved 18 August 2019.

- ^ "NDR 2019: Singapore will be 'principled' in approach to China–US trade dispute; ready to help workers". CNA. Retrieved 18 August 2019.

- ^ Rappeport, Alan; Bradsher, Keith (23 August 2019). "Trump Says He Will Raise Existing Tariffs on Chinese Goods to 30%". The New York Times. Retrieved 25 August 2019.

- ^ "IMF – The "Great Lockdown" Is Set To Triggers The World's Worst Recession Since The 1929 Great Depression". Retrieved 15 April 2020.

- ^ "Great lockdown as bad as Great Depression: IMF". The News International. Retrieved 15 April 2020.

- ^ a b "Shadow of Brexit still looms over economy: experts debate the data". The Guardian. 27 December 2019. ISSN 0261-3077. Retrieved 15 April 2020.

- ^ Partington, Richard (25 October 2019). "How has Brexit vote affected the UK economy? October verdict". The Guardian. ISSN 0261-3077. Retrieved 15 April 2020.

- ^ Amadeo, Kimberly. "Brexit Consequences for the U.K., the EU, and the United States". The Balance. Retrieved 15 April 2020.

- ^ "The Economic Impact of Brexit". rand.org. Retrieved 15 April 2020.

- ^ "What The 1918 Flu Pandemic Teaches Us About The Coronavirus Outbreak". wbur.org. Retrieved 15 April 2020.

- ^ Long, Stephen (8 September 2019). "How a consumer go-slow and a pile of debt is killing the economy". ABC News. Retrieved 16 April 2020.

- ^ Chau, David (4 November 2019). "Retail slumps to 'weakest' level in 28 years as tax cuts fail to stimulate consumer spending". ABC News. Retrieved 16 April 2020.

- ^ Ellyatt, Holly (23 March 2020). "Global economic hit from coronavirus will be felt 'for a long time to come,' OECD warns". CNBC. Retrieved 16 April 2020.

- ^ "Statement on the second meeting of the International Health Regulations (2005) Emergency Committee regarding the outbreak of novel coronavirus (2019-nCoV)". World Health Organization. 30 January 2020. Archived from the original on 31 January 2020. Retrieved 30 January 2020.

- ^ "WHO Director-General's opening remarks at the media briefing on COVID-19 – 11 March 2020". World Health Organization. 11 March 2020. Retrieved 11 March 2020.

- ^ "Here Comes the Coronavirus Pandemic: Now, after many fire drills, the world may be facing a real fire". Editorial. The New York Times. 29 February 2020. Retrieved 1 March 2020.

- ^ "A List of What's Been Canceled Because of the Coronavirus". The New York Times. 1 April 2020. Retrieved 11 April 2020.

- ^ Scipioni, Jade (18 March 2020). "Why there will soon be tons of toilet paper, and what food may be scarce, according to supply chain experts". CNBC. Retrieved 19 March 2020.

- ^ "The Coronavirus Outbreak Could Disrupt the U.S. Drug Supply". Council on Foreign Relations. Retrieved 19 March 2020.

- ^ "COVID-19 Information for Travel". US Centers for Disease Control and Prevention. 11 February 2020. Retrieved 25 February 2020.

- ^ "Coronavirus Disease 2019 (COVID-19) – Transmission". Centers for Disease Control and Prevention. 17 March 2020. Retrieved 29 March 2020.

- ^ "Real-time data show virus hit to global economic activity". Financial Times. 22 March 2020. Archived from the original on 22 March 2020. Retrieved 22 March 2020.

- ^ Schwartz, Nelson D. (21 March 2020). "Coronavirus Recession Looms, Its Course 'Unrecognizable'". The New York Times. Archived from the original on 24 March 2020. Retrieved 24 March 2020.

- ^ Horowitz, Julia. "A 'short, sharp' global recession is starting to look inevitable". CNN. Archived from the original on 20 March 2020. Retrieved 26 March 2020.

- ^ Lowrey, Annie (9 March 2020). "The Coronavirus Recession Will Be Unusually Difficult to Fight". The Atlantic. Archived from the original on 24 March 2020. Retrieved 24 March 2020.

- ^ Jenkins, Simon (9 March 2020). "There will be no easy cure for a recession triggered by the coronavirus". The Guardian. Archived from the original on 24 March 2020. Retrieved 24 March 2020.

- ^ "ECR Risk Experts Contemplate another Financial Crisis", Euromoney, 20 March 2020 Jeremy Weltman

- ^ Badger, Emily; Parlapiano, Alicia (7 May 2020). "Government Orders Alone Didn't Close the Economy. They Probably Can't Reopen It". The New York Times. ISSN 0362-4331. Retrieved 8 May 2020.

- ^ Murray, Dr. Christopher (11 May 2020). "Expert explains why estimated US deaths have doubled". CNN Video. Retrieved 11 May 2020.

- ^ Silver, Nate (10 May 2020). "A lot of evidence suggests that formal re-opening policies are only loosely correlated with people's behavior". @NateSilver538. Retrieved 10 May 2020.

- ^ "Mobility Trends Reports". Apple Maps. Retrieved 10 May 2020.

- ^ "Oil prices fall as coronavirus spreads outside China". Associated Press. 29 February 2020. Archived from the original on 8 March 2020.

- ^ "Coronavirus set to knock oil demand growth to slowest since 2011". Financial Times. 13 February 2020. Archived from the original on 14 February 2020.

- ^ Kollewe, Julia (4 February 2020). "Opec discusses coronavirus as Chinese oil demand slumps – as it happened". The Guardian. Archived from the original on 6 February 2020.

- ^ Johnson, Keith (5 March 2020). "OPEC Tries to Forestall a Coronavirus Oil Collapse". Foreign Policy. Archived from the original on 7 March 2020.

- ^ Stevens, Pippa; Meredith, Sam (6 March 2020). "Oil plunges 10% for worst day in more than 5 years after OPEC+ fails to agree on a massive production cut". CNBC. Archived from the original on 8 March 2020.

- ^ Kelly, Stephanie (8 March 2020). "Oil plunges 25%, hit by erupting Saudi-Russia oil price war". Reuters. Archived from the original on 9 March 2020.

- ^ "Saudi-Russian price war sends oil and stockmarkets crashing". The Economist. 9 March 2020. Archived from the original on 9 March 2020.

- ^ Stevens, Pippa (8 March 2020). "Oil prices plunge as much as 30% after OPEC deal failure sparks price war". CNBC. Archived from the original on 9 March 2020.

- ^ "Oil Prices, Stocks Plunge After Saudi Arabia Stuns World With Massive Discounts". NPR. 8 March 2020. Archived from the original on 10 March 2020.

- ^ Telford, Taylor; Englund, Will; Heath, Thomas. "U.S. markets crater with stocks down more than 5 percent as coronavirus spreads". The Washington Post. Archived from the original on 8 March 2020.

- ^ Mufson, Steven; Englund, Will. "Oil price war threatens widespread collateral damage". The Washington Post. Retrieved 9 March 2020.

- ^ Egan, Matt (9 March 2020). "Oil crashes by most since 1991 as Saudi Arabia launches price war". CNN. Archived from the original on 9 March 2020.

- ^ "Saudi Arabia and Russia Reach Deal to Cut Oil Production". Foreign Policy. 10 April 2020.

- ^ "Saudi, Russia agree oil cuts extension, raise pressure for compliance". Reuters. 3 June 2020.

- ^ "Saudi Arabia, Russia Agree to Record Oil Cut Under US Pressure as Demand Crashes". VOA News. Reuters. 9 April 2020.

- ^ Lee, Nathaniel (16 June 2020). "How negative oil prices revealed the dangers of the futures market". CNBC. Retrieved 5 July 2020.

- ^ Samuelson, Robert J. (12 March 2020). "What Crash of 2020 Means". The Washington Post. Retrieved 12 March 2020.

- ^ Wearden, Graeme; Jolly, Jasper (12 March 2020). "Wall Street and FTSE 100 plunge on worst day since 1987 – as it happened". The Guardian. ISSN 0261-3077. Retrieved 12 March 2020.

- ^ Williams, Sean (10 March 2020). "Stock Market Crash 2020: Everything You Need to Know". The Motley Fool. Retrieved 12 March 2020.

- ^ Smith, Elliot (28 February 2020). "Global stocks head for worst week since the financial crisis amid fears of a possible pandemic". CNBC. Archived from the original on 28 February 2020.

- ^ Imbert, Fred; Huang, Eustance (27 February 2020). "Dow falls 350 points Friday to cap the worst week for Wall Street since the financial crisis". CNBC. Archived from the original on 28 February 2020.

- ^ Smith, Elliot (28 February 2020). "European stocks fall 12% on the week as coronavirus grips markets". CNBC. Archived from the original on 28 February 2020.

- ^ Menton, Jessica (27 February 2020). "Dow plunges 1,191 points, its biggest one-day point drop, as coronavirus fears escalate". USA Today. Retrieved 12 March 2020.

- ^ Peltz, James F. (27 February 2020). "Stock market enters a correction, down 10% from recent peak". Los Angeles Times. Archived from the original on 4 March 2020. Retrieved 12 March 2020.

- ^ Huang, Eustance (28 February 2020). "Seven major Asia-Pacific markets have tumbled into correction territory". CNBC. Archived from the original on 29 February 2020. Retrieved 24 March 2020.

- ^ "Asian shares rise following stimulus-led surge on Wall St". MyNorthwest. Associated Press. 4 March 2020. Archived from the original on 5 March 2020. Retrieved 13 March 2020.

- ^ DeCambre, Mark (7 March 2020). "Wild stock-market swings are 'emotionally and intellectually wearing' on Wall Street". MarketWatch. Archived from the original on 5 March 2020. Retrieved 13 March 2020.

- ^ Partington, Richard; Wearden, Graeme (9 March 2020). "Global stock markets post biggest falls since 2008 financial crisis". The Guardian. ISSN 0261-3077. Archived from the original on 14 March 2020. Retrieved 15 March 2020.

- ^ He, Laura; Duffy, Clare; Horowitz, Julia. "US stocks halted after falling 7%. Global stocks plunge as oil crashes and coronavirus fear spreads". CNN. Archived from the original on 14 March 2020. Retrieved 15 March 2020.

- ^ Prynn, Jonathon; English, Simon; Murphy, Joe (9 March 2020). "Black Monday: Fourth biggest City fall as virus panic hits markets". London Evening Standard. Archived from the original on 11 March 2020. Retrieved 13 March 2020.

- ^ Partington, Richard; Wearden, Graeme (9 March 2020). "Global stock markets post biggest falls since 2008 financial crisis". The Guardian. ISSN 0261-3077. Archived from the original on 12 March 2020. Retrieved 13 March 2020.

- ^ "Milan bourse closes almost 17% down – English". ANSA.it. 12 March 2020. Archived from the original on 18 March 2020. Retrieved 13 March 2020.

- ^ Lopez, Jonathan (12 March 2020). "Europe crude, petchems prices extend losses as stocks suffer 'Black Thursday'". Icis. Archived from the original on 22 March 2020. Retrieved 13 March 2020.

- ^ Burch, Sean (12 March 2020). "Dow Suffers Biggest Point Drop Ever, as Disney and Apple Fall Hard". TheWrap. Archived from the original on 22 March 2020. Retrieved 13 March 2020.

- ^ "Stock market today: Live updates on the Dow, S&P 500, companies and more". CNN. 13 March 2020. Archived from the original on 16 March 2020. Retrieved 16 March 2020.

- ^ Imbert, Fred (16 March 2020). "Here's what happened to the stock market on Monday". CNBC. Archived from the original on 17 March 2020. Retrieved 16 March 2020.

- ^ a b "Global shares plunge in worst day since financial crisis". BBC. 9 March 2020. Archived from the original on 9 March 2020.

- ^ Li, Yun (8 March 2019). "Dow futures tumble as Saudi-Russia oil price war adds to coronavirus stress". NBC News. Archived from the original on 9 March 2020.

- ^ Bayly, Lucy (9 March 2020). "Dow closes with decline of 2,000 points, almost ending 11-year bull market". NBC News. Archived from the original on 9 March 2020.

- ^ Ruhle, Stephanie (9 March 2019). "Stocks plunge at market open, trading halts after Dow drops 1800 points". MSNBC.

- ^ Menton, Jessica. "Dow plummets 2,000 points, oil prices drop as global recession concerns mount". USA Today. Retrieved 10 March 2020.

- ^ "Trillions vaporise from world economy". The News International. Retrieved 10 March 2020.

- ^ "Dow Dives 2,000 Points After Oil Shock". Haaretz. Reuters. 9 March 2020. Retrieved 10 March 2020.

- ^ "Worst day in a decade: Nasdaq, S&P, Dow down nearly 8% in massive market rout". Fortune. Retrieved 10 March 2020.

- ^ Defterios, John (9 March 2020). "Why oil prices are crashing and what it means". CNN. Archived from the original on 15 March 2020. Retrieved 16 March 2020.