BP: Difference between revisions

→External links: rm - main site is adequate |

|||

| Line 463: | Line 463: | ||

* {{Official website|http://www.bp.com/}} |

* {{Official website|http://www.bp.com/}} |

||

* [http://www.bp.com/extendedsectiongenericarticle.do?categoryId=10&contentId=7036819 BP's Corporate History] |

* [http://www.bp.com/extendedsectiongenericarticle.do?categoryId=10&contentId=7036819 BP's Corporate History] |

||

* [http://www.bpsolar.com BP Solar] |

|||

* [http://whiting.bp.com BP Whiting Refinery Information] |

|||

* [http://www.bp.com/productlanding.do?categoryId=6929&contentId=7044622 Statistical Review of World Energy] |

* [http://www.bp.com/productlanding.do?categoryId=6929&contentId=7044622 Statistical Review of World Energy] |

||

* [http://www.youtube.com/user/BPplc BP's YouTube page] |

* [http://www.youtube.com/user/BPplc BP's YouTube page] |

||

Revision as of 11:58, 22 August 2012

| File:BP Logo.svg | |

| Company type | Public limited company |

|---|---|

| LSE: BP, NYSE: BP | |

| ISIN | DE0008618737 |

| Industry | Oil and gas |

| Founded | 1909 (as the Anglo-Persian Oil Company) 1954 (as the British Petroleum Company) 1998 (merger of British Petroleum and Amoco) |

| Headquarters | London, United Kingdom |

Area served | Worldwide |

Key people | Carl-Henric Svanberg (Chairman) Bob Dudley (CEO) Brian Gilvary (CFO)[1] |

| Products | Petroleum Natural gas Motor fuels Aviation fuels |

| Services | Service stations |

| Revenue | |

| Total assets | |

| Total equity | |

Number of employees | 79,700 (2011)[2] |

| Website | www |

BP p.l.c.[3][4] (LSE: BP, NYSE: BP) is a British multinational oil and gas company headquartered in London, United Kingdom. It is the third-largest energy company and fourth-largest company in the world measured by 2011 revenues and is one of the six oil and gas "supermajors".[5][6] It is vertically integrated and operates in all areas of the oil and gas industry, including exploration and production, refining, distribution and marketing, petrochemicals, power generation and trading. It also has renewable energy activities in wind power and biofuels.

BP has operations in over 80 countries, produces around 3.4 million barrels of oil equivalent per day and has around 21,800 service stations worldwide.[7][8] Its largest division is BP America, which is the second-largest producer of oil and gas in the United States.[9] BP owns 50% of TNK-BP, which is the third-largest oil company in Russia measured by both reserves and crude oil production. As of December 2011[update], BP had total proven commercial reserves of 17.75 billion barrels of oil equivalent.[10] BP has a primary listing on the London Stock Exchange and is a constituent of the FTSE 100 Index. It had a market capitalisation of £81.4 billion as of 6 July 2012, the fourth-largest of any company listed on the London Stock Exchange.[11] It has a secondary listing on the New York Stock Exchange.

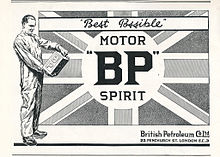

BP's origins date back to the founding of the Anglo-Persian Oil Company in 1909, established as a subsidiary of Burmah Oil Company to exploit oil discoveries in Iran. In 1935, it became the Anglo-Iranian Oil Company and in 1954 British Petroleum.[12][13] In 1959, the company expanded beyond the Middle East to Alaska and in 1965 it was the first company to strike oil in the North Sea. British Petroleum acquired majority control of Standard Oil of Ohio in 1978. Formerly majority state-owned, the British government privatised the company in stages between 1979 and 1987. British Petroleum merged with Amoco in 1998 and acquired ARCO and Burmah Castrol in 2000.

BP has been involved in a number of major environmental and safety incidents, including the 2010 Deepwater Horizon oil spill.In 1997 it became the first major oil company to publicly acknowledge the need to take steps against climate change.[14]

History

1909 to 1979

In May 1901, William Knox D'Arcy was granted a concession by the Shah of Iran to search for oil, which he discovered in May 1908.[15] This was the first commercially significant find in the Middle East. On 14 April 1909, the Anglo-Persian Oil Company (APOC) was incorporated as a subsidiary of Burmah Oil Company to exploit this.[15] In 1923, it employed future Prime Minister, Winston Churchill as a paid consultant, to lobby the British government to allow Burmah to have exclusive rights to Persian oil resources, which were successfully granted.[16] In 1935, it became the Anglo-Iranian Oil Company (AIOC).[15]

Following World War II, AIOC and the Iranian government initially resisted nationalist pressure to revise AIOC's concession terms still further in Iran's favour. But in March 1951, the pro-western Prime Minister Ali Razmara was assassinated.[17] The Majlis of Iran (parliament) elected a nationalist, Mohammed Mossadeq, as prime minister. In April, the Majlis nationalised the oil industry by unanimous vote.[18] The National Iranian Oil Company was formed as a result, displacing the AIOC.[19] The AIOC withdrew its management from Iran, and organised an effective boycott of Iranian oil. The British government, which owned the AIOC, contested the nationalisation at the International Court of Justice at The Hague, but its complaint was dismissed.[20]

By spring of 1953, incoming US President Dwight D. Eisenhower authorised the Central Intelligence Agency (CIA) to organise a coup against the Mossadeq government, known as the 1953 Iranian coup d'état. Classified documents show British intelligence officials played a pivotal role in initiating and planning the coup, and that Washington and London shared an interest in maintaining control over Iranian oil.[21] The coup had its roots in Britain's conflict with Iran.[22] On 19 August 1953, Mossadeq was forced from office by the CIA conspiracy, involving the Shah and the Iranian military, and known by its codename, Operation Ajax.[21]

Mossadeq was replaced by pro-Western general Fazlollah Zahedi[23] and the Shah, who returned to Iran after having left the country briefly to await the outcome of the coup. The Shah abolished the democratic Constitution and assumed autocratic powers.

After the coup, Mossadeq's National Iranian Oil Company became an international consortium, and AIOC resumed operations in Iran as a member of it.[19] The consortium agreed to share profits on a 50–50 basis with Iran, "but not to open its books to Iranian auditors or to allow Iranians onto its board of directors."[24] AIOC, as a part of the Anglo-American coup d'état deal, was not allowed to monopolise Iranian oil as before. It was limited to a 40% share in a new international consortium. For the rest, 40% went to the five major American companies and 20% went to Royal Dutch Shell and Compagnie Française des Pétroles, now Total S.A..[25]

The AIOC became the British Petroleum Company in 1954. In 1959, the company expanded beyond the Middle East to Alaska[26] and in 1965 it was the first company to strike oil in the North Sea.[27] In 1978 the company acquired a controlling interest in Standard Oil of Ohio or Sohio, a breakoff of the former Standard Oil that had been broken up after anti-trust litigation.[28] In 1967 the giant oil tanker, the Torrey Canyon, foundered off the English coast, even though the ship was flying the well known flag of convenience, that of Liberia. The ship was in fact operated on behalf of BP. The Prime Minister of that time, 1967, had the ship bombed by RAF jet bombers, in an effort to break the ship up and sink it (see Torrey Canyon oil spill). This was unsuccessful, and the method has not been repeated. BP continued to operate in Iran until the Islamic Revolution in 1979. The new regime of Ayatollah Khomeini confiscated all of the company’s assets in Iran without compensation, bringing to an end its 70-year presence in Iran.

1979 to 2000

Sir Peter Walters was the company chairman from 1981 to 1990.[29] This was the era of the Thatcher government's privatisation strategy. The British government sold its entire holding in the company in several tranches between 1979 and 1987.[30] The sale process was marked by an attempt by the Kuwait Investment Authority, the investment arm of the Kuwait government, to acquire control of the company.[31] This was ultimately blocked by the strong opposition of the British government. In 1987, British Petroleum negotiated the acquisition of Britoil[32] and the remaining publicly traded shares of Standard Oil of Ohio.[28]

Walters was replaced by Robert Horton in 1989. Horton carried out a major corporate down-sizing exercise removing various tiers of management at the Head Office.[33]

Standard Oil of California and Gulf Oil merged in 1984, the largest merger in history at that time. Under the anti-trust regulation, SoCal divested many of Gulf's operating subsidiaries, and sold some Gulf stations and a refinery in the eastern United States.[34]

John Browne, who had been on the board as managing director since 1991, was appointed group chief executive in 1995.[35]

2000 to 2010

British Petroleum merged with Amoco (formerly Standard Oil of Indiana) in December 1998,[36] becoming BP Amoco plc.[37] In 2000, BP Amoco acquired Arco (Atlantic Richfield Co.)[38] and Burmah Castrol plc.[39] As part of the merger's brand awareness, the company helped the Tate Modern British Art launch RePresenting Britain 1500–2000[40] In 2001, the company formally renamed itself as BP plc[37] and adopted the tagline "Beyond Petroleum," which remains in use today. It states that BP was never meant to be an abbreviation of its tagline. Most Amoco stations in the United States were converted to BP's brand and corporate identity. In many states BP continued to sell Amoco branded petrol even in service stations with the BP identity as Amoco was rated the best petroleum brand by consumers for 16 consecutive years and also enjoyed one of the three highest brand loyalty reputations for petrol in the US, comparable only to Chevron and Shell. In May 2008, when the Amoco name was mostly phased out in favour of "BP Gasoline with Invigorate", promoting BP's new additive, the highest grade of BP petrol available in the United States was still called Amoco Ultimate.

In April 2004, BP decided to move most of its petrochemical businesses into a separate entity called Innovene within the BP Group. In 2005, it was sold to INEOS, a privately held UK chemical company for $9 billion.[41][42]

In 2005, BP announced that it would be leaving the Colorado market.[43] Many locations were re-branded as Conoco.[44] In 2006, when Chevron Corporation gave exclusive rights to the Texaco brand name in the US Texaco sold most of the BP gas stations in the southeast. BP has recently looked to grow its oil exploration activities in frontier areas such as the former Soviet Union for its future reserves.[45]

In 2007, BP sold its corporate-owned convenience stores, typically known as "BP Connect", to local franchisees and jobbers.[46]

On 12 January 2007, it was announced that Lord Browne would retire as chief executive at the end of July 2007.[47] The new Chief Executive, Tony Hayward, had been head of exploration and production. It had been expected that Lord Browne would retire in February 2008 when he reached the age of 60, the standard retirement age at BP. Browne resigned abruptly from BP on 1 May 2007, following the lifting of a legal injunction preventing Associated Newspapers from publishing details about his gay lover. Hayward succeeded Browne with immediate effect.[48]

2010 to present

On 1 October 2010, Bob Dudley replaced Tony Hayward as the company's CEO after the Deepwater Horizon oil spill.[49]

On 15 January 2011, Rosneft and BP announced a deal to jointly develop East-Prinovozemelsky field on the Russian arctic shelf. As part of the deal, Rosneft will receive 5% of BP's shares (worth approximately $7.8 billion, as of January 2011) and BP will get approximately 9.5% of Rosneft's shares in exchange.[50] According to the deal, the two companies will also create an Arctic technology centre in Russia to develop technologies and engineering practices for safe arctic hydrocarbons extraction.[51]

In February 2011, BP formed a partnership with Reliance Industries, taking a 30 percent stake in a new Indian joint-venture for an initial payment of $7.2 billion.[52]

BP announced in June 2012 that it planned to sell its 50% shareholding in the Russian oil company TNK-BP, which accounted for 30 percent of BP’s oil and natural gas production, 20% of its reserves and roughly 10% of BP's profit over the last ten years. BP said that no sale was guaranteed, but that the company had received "indications of interest".[53][54]

Operations

BP has operations in around 80 countries worldwide.[55] BP's global headquarters are located in the St James's area of London, United Kingdom and its exploration headquarters are located in Houston, United States.[56][57] As of January 2012, the company had a total of 83,400 employees.[58][59] Around 20 percent of the company's workforce is based in the United Kingdom[60] and 28 percent is based in the United States.[61] BP operations are organised into three main "business segments": Upstream, Downstream, and BP Alternative Energy.[62][59]

United Kingdom

BP is the UK’s largest producer of oil and Europe’s second largest producer of natural gas.[63] As of 2011[update] the company employs more than 15,000 people in the UK and Ireland, or about 20% of its total workforce.[64][60] Its North Sea operations are headquartered in Aberdeen, Scotland, where it employs around 3,000 people.[65]

BP operates more than 40 offshore oil and gas fields, four onshore terminals and a pipeline network that transports around 50 percent of the oil and gas produced in the UK, according to the company.[66][67] As of 2011[update], BP had produced 5 billion barrels of oil and gas equivalent in the North Sea[68] and its current level of production is about 200,000 barrels per day,[69][70] BP has invested more than £35 billion in the North Sea since the 1960s, and in 2012 announced its plans to invest another £10 billion over the next five years, with six major projects in the UK and Norway under development.[71][65]

Offshore oil fields under development by BP include the Clair oilfield, west of the Shetland Isles, which has been appraised as the largest hydrocarbon resource in the UK.[69] In 2011, the UK government approved the development of an extension to the field, the Clair Ridge, for which BP will be the lead operator.[69] As of 2012[update], the company announced that it was focusing its investment in the UK North Sea into four development projects including the Clair Field, Devenick gas field, the Schiehallion and Loyal oilfields and the Kinnoull oilfield.[68][72]

In Saltend near Hull, BP operates a petrochemicals plant that produces acetic acid and acetic anhydride used in the production of pharmaceuticals, textiles and other chemical products.[73][70] At the same location, the company operates a biofuel technology demonstration plant in partnership with DuPont, which uses feedstocks such as wheat to produce biobutanol.[74] The company is also preparing to start production at a bioethanol plant in Hull, developed with Associated British Foods and DuPont.[75][76]

BP has a major corporate campus in Sunbury-on-Thames which is home to around 4,500 employees and over 40 business units..[77] BP's trading functions are based at 20 Canada Square in Canary Wharf, London, where around 2,200 employees are based.[77] BP also has three research and development facilities in the UK.[59]

Retail sites operated by BP in the UK include over 1100 service stations.[78] Its flagship retail brand is BP Connect, a chain of service stations combined with a convenience store and a café called the "Wild Bean Cafe".[79][80] More than 120 BP Connect sites in the UK are run in partnership with Marks & Spencer and include an onsite M&S Simply Food shop.[81]

United States

In the United States, BP has the largest oil and gas reserves of any company and is the second-largest producer of oil and gas, and the largest producer in the deepwater Gulf of Mexico.[82][83] In Alaska, BP operates 13 oil fields in the North Slope region and is the largest owner of the 800-mile long Trans-Alaska Pipeline System.[84][85] In the lower 48 states, the company is the country's sixth largest natural gas producer with a total of 10,000 wells.[86] Its alternative energy operations in the US include 13 wind farms and a $400 million investment in advanced cellulosic biofuels in Florida.[87][88][89]

Other countries

Outside of the United Kingdom and United States, BP's key operations include offshore oil wells and onshore processing facilities in Brazil,[90] Azerbaijan,[91] Trinidad & Tobago[92] and China.[93] BP's largest onshore oil and gas exploration and production activities are based in Iraq, where it operates 20 oil rigs in the world's fourth largest oilfield,[94] and Russia.[59] In Indonesia, BP operates major liquid natural gas activities and began investment into coalbed methane in 2011.[95] BP has announced a $7.2 billion investment in offshore oil and gas exploration in India.[96] The company operates refineries in countries including Australia, New Zealand and South Africa. Its petrochemicals, lubricants, fuels and related services are marketed in Europe, Asia and Australasia.[59] BP operates biofuel production facilities in Brazil, including three cane sugar mills for ethanol production.[97][98]

Upstream

BP Upstream's activities include exploring for new oil and natural gas resources, developing access to such resources, and producing, transporting, storing and processing oil and natural gas.[99][100] Upstream is responsible for the operation of BP's wells, pipelines, offshore platforms and processing facilities. The activities in this area of operations take place in 30 countries worldwide, including Angola, Azerbaijan, Brazil, Canada, Egypt, India, Iraq, Norway, Russia, Trinidad & Tobago, the UK, and the US.[59]

Downstream

BP Downstream's activities include refining, marketing, manufacturing, transportation, trading and supply of crude oil, petrochemicals products and petroleum.[99] Downstream is responsible for BP's fuels, lubricants and petrochemical businesses and has major operations located in Europe, North America and Asia.[101] BP owns or holds a share in 16 refineries worldwide, of which seven are located in Europe and five are in the US. The company also has 21,800 service stations and markets its products in approximately 70 countries worldwide.[59]

Air BP

Air BP is the aviation division of BP, providing aviation fuel, lubricants & services. It has operations in over 50 countries worldwide.

BP Shipping

BP Shipping provides the logistics to move BP's oil and gas cargoes to market, as well as marine structural assurance[102] on everything that floats in the BP group. It manages a large fleet of vessels most of which are held on long-term operating leases. BP Shipping's chartering teams based in London, Singapore, and Chicago also charter third party vessels on both time charter and voyage charter basis.

The BP-managed fleet consists of Very Large Crude Carriers (VLCCs), one North Sea shuttle tanker, medium size crude and product carriers, liquefied natural gas (LNG) carriers, liquefied petroleum gas (LPG) carriers, and coasters. All of these ships are double-hulled.[103]

Lubricants

Castrol is BP's main brand for industrial and automotive lubricants and is applied to a large range of BP oils, greases and similar products for most lubrication applications.

Service stations

BP has around 21,800 service stations worldwide, which are primarily operated under the BP brand.[7] In Germany and Luxembourg, BP operates service stations under the Aral brand, having acquired the majority of Veba Öl AG in 2001 and subsequently rebranded its existing stations in Germany to the Aral name. On the US West Coast, in the states of California, Oregon, Washington, Nevada, Idaho, Arizona, and Utah, BP primarily operates service stations under the ARCO brand, having acquired ARCO in 2000. ARCO is a popular "cash only" retailer, selling products refined from Alaska North Slope crude at the Cherry Point Refinery in Washington, a plant in Los Angeles, and at other contract locations on the West Coast.

BP Connect is BP's flagship retail brand and operates worldwide. BP Connect sites feature the Wild Bean Cafe, which offers cafe-style coffee and a selection of hot food as well as freshly baked muffins and sandwiches. BP Connect sites usually offer table and chair seating and often an Internet kiosk. Some BP Connect sites in the UK are run in partnership with Marks & Spencer, with the on-site shop being an M&S Simply Food. In the US, the BP Connect concept is gradually being transitioned to the ampm brand and concept.

In Australia BP operates a number of BP Travel Centres, large-scale destination sites located which, in addition to the usual facilities in a BP Connect site, also feature major food-retail tenants such as McDonald's, KFC, Nando's and Krispy Kreme, with a large seating capacity food court and facilities for long-haul truck drivers, including a lounge, showers and washing machines.

BP Canada operated retail locations in Canada from 1948 to 1982, which were sold and rebranded as Petro Canada.

BP Alternative Energy

BP's alternative energy business was launched in 2005[104] and invests in wind power and biofuel projects.[88] In 2005 the company committed to spending $8 billion on renewable energy over 10 years and as of December 2011[update], had invested approximately $7 billion in this area.[105]

Between 2005 and 2010, BP invested about $5 billion in its renewable energy business, mainly in biofuel and wind power projects. In 2011, BP planned to invest $1 billion in renewables, roughly the same amount it invested in 2010.[106]

In 2011, BP announced a plan to construct a biofuel refinery in the Southeastern US. In 2010, it took a full control of Vercipia Biofuels, a cellulosic ethanol producer originally established as a joint venture with Verenium Corporation. In Brazil, BP holds a 50% stake in Tropical BioEnergia and plans to operate two ethanol refineries. In the US BP has more than 1,200 megawatts (MW) of wind-powered electricity capacity. In July 2010, the company began construction of the 250 MW Cedar Creek II Wind Farm in Colorado.[106]

BP's former subsidiary BP Solar was a producer of solar panels after purchasing Lucas Energy Systems in 1980 and Solarex (as part of its acquisition of Amoco) in 2000. Through a series of acquisitions in the solar power industry BP Solar became the third largest producer of solar panels in the world. BP Solar had a 20% world market share in photovoltaic panels in 2004 when it had a capacity to produce 90 MW/year of panels. Due to competition from China, BP closed its US plants in Frederick, Maryland as part of a transition to manufacturing in China.[107] In December 2011, BP Solar was closed and BP withdrew from the solar power industry, saying it was no longer profitable.[108][108][109][110]

Corporate affairs

Senior management

The current members of the BP board of directors are:[111]

- Carl-Henric Svanberg – Chairman;

- Robert Dudley – CEO (since 1 October 2010);

- Iain Conn – Chief Executive, Refining and Marketing;

- Brian Gilvary – Chief Financial Officer;

- Byron Grote – Executive Vice President, Corporate Business Activities;

- David Jackson – company secretary;

- Paul Anderson – non-executive director;

- Frank Bowman – non-executive director;

- Antony Burgmans – non-executive director;

- Cynthia Carroll – non-executive director;

- George David – non-executive director;

- Ian Davis – non-executive director;

- Ann Dowling – non-executive director;

- Brendan Nelson – non-executive director;

- Phuthuma Nhleko – non-executive director; and

- Andrew Shilston – non-executive director.

Financial data

| Year | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 |

|---|---|---|---|---|---|---|---|---|

| Sales | 180,186 | 236,045 | 294,849 | 249,465 | 265,906 | 284,365 | 361,341 | 239,272 |

| EBITDA | 22,941 | 28,200 | 37,825 | 41,453 | 44,835 | |||

| Net results | 6,845 | 10,267 | 15,961 | 22,341 | 22,000 | 20,845 | 21,157 | 16,578 |

| Net debt | 20,273 | 20,193 | 21,607 | 16,202 | 16,202 |

- Source :OpesC

Company name

Until 31 December 1998 the company was formally registered as the British Petroleum Company plc. Following a merger with Amoco the company adopted the name BP Amoco plc in January 1999, which was retained until May 2001 when the company was renamed BP p.l.c.[112][113] In the first quarter of 2001 the company adopted the marketing name of BP, replaced its “Green Shield” logo with the Helios symbol, a green and yellow sunflower pattern, and introduced a new corporate slogan – “Beyond Petroleum”. The transition to the name and logo was managed by the advertising agency Ogilvy & Mather and the PR consultants, Ogilvy PR.[114] The Helios logo (Helios is the name of the Greek sun god), is designed to represent energy in its many forms. BP's tagline, "Beyond Petroleum", according to the company represents their focus on meeting the growing demand for fossil fuels, manufacturing and delivering more advanced products, and enabling the material transition to a lower carbon future.[115]

Environmental record

BP was named by Multinational Monitor as one of the ten worst corporations in both 2001 and 2005 based on its environmental and human rights records.[116] In 1991 BP was cited as the most polluting company in the US based on EPA toxic release data. BP has been charged with burning polluted gases at its Ohio refinery (for which it was fined $1.7 million), and in July 2000 BP paid a $10 million fine to the EPA for its management of its US refineries.[117] According to PIRG research, between January 1997 and March 1998, BP was responsible for 104 oil spills.[118]

Environmental initiatives

As of 11 February 2007, BP announced that it would spend $8 billion over ten years to research alternative methods of fuel, including natural gas, hydrogen, solar, and wind. A $500 million grant to the University of California, Berkeley, Lawrence Berkeley National Laboratory, and the University of Illinois at Urbana-Champaign, to create an Energy Biosciences Institute[119] has recently come under attack over concerns about the global impacts of the research and privatisation of public universities.[120]

BP patented the Dracone Barge to aid in oil spill clean-ups across the world.[121]

BP was a founding sponsor of the University of East Anglia's Climatic Research Unit in 1971.[122]

BP was a member of the Global Climate Coalition an industry organisation established to promote global warming scepticism but withdrew in 1997, saying "the time to consider the policy dimensions of climate change is not when the link between greenhouse gases and climate change is conclusively proven, but when the possibility cannot be discounted and is taken seriously by the society of which we are part. We in BP have reached that point.".[123]

In March 2002, Lord John Browne, the group chief executive of BP, declared in a speech that global warming was real and that urgent action was needed, saying that "Companies composed of highly skilled and trained people can't live in denial of mounting evidence gathered by hundreds of the most reputable scientists in the world."[124]

BP is a sponsor of the Scripps Institution CO2 program to measure carbon dioxide levels in the atmosphere.[125]

In 2009, Tony Hayward apparently shifted gears from former chief executive Lord Browne's focus on alternative energy, announcing that safety was the company's "number one priority".[126]

Accusations of greenwashing

BP's investment in green technologies peaked at 4% of its exploratory budget, but they have since closed their Solar Programme[127] as well as their alternative energy headquarters in London. As such they invest more than other oil companies, but it has been called greenwashing due to the small proportion of the overall budget.[128]

BP was a nominee for the 2009 Greenwash Awards for deliberately exaggerating its environmental credentials. According to Greenpeace, in 2008 BP invested $20 billion in fossil fuels, but only $1.5 billion in all alternative forms of energy.[129]

In July 2006, critics pointed to the relative lack of press coverage about a spill of 270,000 gallons of crude oil that spread into the Alaskan tundra, noting this as evidence that BP had successfully greenwashed its image, while maintaining environmentally unsound practices.[130][131]

In 2008, BP was awarded a satirical prize, the "Emerald Paintbrush" award, from Greenpeace UK. The "Emerald Paintbrush" award was given to BP in order to highlight its alleged greenwashing campaign. Critics point out that while BP advertises its activities in alternative energy sources, the majority of its capital investments continue to go into fossil fuels.[132] BP was also one nominee for the 2009 Greenwash Awards.[133]

Hazardous substance dumping 1993–1995

In September 1999, one of BP’s US subsidiaries, BP Exploration Alaska (BPXA), agreed to resolve charges related to the illegal dumping of hazardous wastes on the Alaska North Slope, for $22 million. The settlement included the maximum $500,000 criminal fine, $6.5 million in civil penalties, and BP’s establishment of a $15 million environmental management system at all of BP facilities in the US and Gulf of Mexico that are engaged in oil exploration, drilling or production. The charges stemmed from the 1993 to 1995 dumping of hazardous wastes on Endicott Island, Alaska by BP’s contractor Doyon Drilling. The firm illegally discharged waste oil, paint thinner and other toxic and hazardous substances by injecting them down the outer rim, or annuli, of the oil wells. BPXA failed to report the illegal injections when it learned of the conduct, in violation of the Comprehensive Environmental Response, Compensation and Liability Act.[134]

Prudhoe Bay 2006–2007

In August 2006, BP shut down oil operations in Prudhoe Bay, Alaska, due to leaking wells. The wells were leaking an insulating agent called Arctic pack, consisting of crude oil and diesel fuel, which is placed between the wells and ice to prevent freezing.[135] BP had also spilled over one million litres of oil in Alaska's North Slope due to corrosion in the feeding pipeline to the Alaska Pipeline.[136] This corrosion is caused by sediment collecting in the bottom of the pipe, protecting corrosive bacteria from chemicals sent through the pipeline to fight these bacteria. There are estimates that about 5,000 barrels (790 m3) of oil were released from the pipeline. To date 1,513 barrels (240.5 m3) of liquids, about 5,200 cubic yards (4,000 m3) of soiled snow and 328 cubic yards (251 m3) of soiled gravel have been recovered. After approval from the DOT, only the eastern portion of the field was shut down, resulting in a reduction of 200,000 barrels per day (32,000 m3/d) until work began to bring the eastern field to full production on 2 October 2006.[137]

In May 2007, the company announced another partial field shutdown owing to leaks of water at a separation plant. Their action was interpreted as another example of fallout from a decision to cut maintenance of the pipeline and associated facilities.[138]

On 16 October 2007, Alaska Department of Environmental Conservation officials reported a toxic spill of methanol (methyl alcohol) at the Prudhoe Bay oil field managed by BP PLC. Nearly 2,000 gallons of mostly methanol, mixed with some crude oil and water, spilled onto a frozen tundra pond as well as a gravel pad from a pipeline. Methanol, which is poisonous to plants and animals, is used to clear ice from the insides of the Arctic-based pipelines.[139]

2008 Caspian Sea gas leak and blowout

On 17 September 2008, a gas leak was discovered and one gas-injection well blown out in the area of the Central Azeri platform at the Azeri oilfield, a part of the Azeri–Chirag–Guneshli project, in the Azerbaijan sector of Caspian Sea.[140][141][142] The platform was shut down and the staff was evacuated.[140][141] As the Western Azeri Platform was being powered by a cable from the Central Azeri Platform, it was also shut down.[143] According to US Embassy cables, BP had been "exceptionally circumspect in disseminating information" and revealed that BP thought the cause for the blowout was a bad cement job.[142][144] Production at the Western Azeri Platform resumed on 9 October 2008 and at the Central Azeri Platform in December 2008.[145][146]

2010 Texas City chemical leak

Two weeks prior to the Deepwater Horizon explosion, BP admitted that malfunctioning equipment lead to the release of over 530,000 lbs of chemicals into the air of Texas City and surrounding areas from 6 April to 16 May. The leak included 17,000 pounds of benzene (a known carcinogen), 37,000 pounds of nitrogen oxides (which contribute to respiratory problems), and 186,000 pounds of carbon monoxide.[147][148] In June 2012, over 50,000 Texas City residents joined a class-action suit against BP, alleging they got sick in 2010 from the 41-day emissions release from the refinery. Texas has also sued BP over the release of emissions. BP says the release harmed no one.[149]

2010 Deepwater Horizon oil spill

On 20 April 2010, the semi-submersible exploratory offshore drilling rig Deepwater Horizon exploded after a blowout; it sank two days later, killing 11 people and causing the largest accidental marine oil spill in the history of the petroleum industry.[150][151][152] An estimated 4.9 million barrels of oil[153] was spilled and 1.8 million gallons of Corexit dispersant was applied.[154] This blowout in the Macondo Prospect field in the Gulf of Mexico resulted in a partially capped oil well one mile below the surface of the water. Experts estimate that the gusher flowed at a rate of 35,000 to 60,000 barrels per day (5,600 to 9,500 m3/d) of oil.[155][156][157] The exact flow rate was uncertain due to the difficulty of installing measurement devices at that depth and is a matter of ongoing debate.[158] In May 2012, Federal investigators began exploring whether BP representatives lied to Congress regarding the oil flow rate and whether engineers tried to withhold data.[159]

The resulting oil slick covered at least 2,500 square miles (6,500 km2), fluctuating from day to day depending on weather conditions,[160] threatening the coasts of Louisiana, Mississippi, Alabama, Texas, and Florida.

The drilling rig was owned and operated by Transocean Ltd[161] on behalf of BP, which is the majority owner of the Macondo oil field. At the time of the explosion, there were 126 crew on board; seven were employees of BP and 79 of Transocean. There were also employees of various other companies involved in the drilling operation, including Anadarko, Halliburton and M-I Swaco.[162]

On July 15, 2010, the well was capped, stopping the flow of oil from the riser pipe.[163] Two Relief wells were completed in mid-September 2010.[164]

Beginning in August 2010, oil has been spotted bubbling to the surface near the Macondo site, causing large oil slicks. Edward Overton, professor emeritus at LSU's environmental sciences department, examined oil samples taken from the area in September 2011 and confirmed that the oil came from the Macondo reservoir. The oil is thought by experts to be coming from a seep in the seabed, although there is debate about what caused the seep. Experts believe it may have been caused by the blowout well and subsequent failed attempts to cap it during spring 2010.[165][166]

In October 2011, a NOAA report stated that dolphins and whales were dying at twice the normal rate.[167] By 2012, at least 749 cetaceans (dolphins and whales) had died.[168] Scientists estimate that for every dead dolphin found there are as many as 50 dead animals that do not make it to Gulf shores.[169] In April 2012, scientists reported finding alarming numbers of mutated crab, shrimp and fish they believed to be the result of chemicals released during the oil spill.[170] In April 2012, oil was found dotting 200 miles of Louisiana's coast.[171]

The US Government named BP the responsible party, and officials committed to hold the company accountable for all clean-up costs and other damage.[172][173] BP agreed to create a $20 billion spill response fund administered by Kenneth Feinberg.[174][175][176] The size of fund was not a cap or a floor on BP's liabilities. In order to fund the payments, BP cut its capital spending budget, sold $10 billion in assets, and dropped its dividend.[174][177] BP has also been targeted in litigation over the claims process it put in place for victims. A class action lawsuit was filed against BP and its initial claims administrator, the ACE, Ltd. Insurance Group company ESIS.[178]

In March 2012 BP agreed to a $7.8 billion settlement meant as compensation for fishermen, condo owners and others hurt by the oil spill. The money came from the $20 billion escrow. By June 2012, the company had paid out an additional $7.5 billion in compensation and clean-up costs.[179]

Mist mountain project

There have been some calls by environmental groups for BP to halt its "Mist Mountain" Coalbed Methane Project in the Southern Rocky Mountains of British Columbia and for the UN to investigate the mining activities.[180] The proposed 500 km² project is directly adjacent to the Waterton-Glacier International Peace Park.[181]

Canadian oil sands

BP is one of numerous firms who are extracting oil from Canadian oil sands, a process that produces four times as much CO2 as conventional drilling.[182] The Cree First Nation describe this as 'the biggest environmental crime on the planet'.[183]

Accidents

1965 Sea Gem offshore oil rig disaster

In December 1965, while the BP oil rig Sea Gem was being moved, two of its legs collapsed and the rig capsised. Thirteen crew were killed. Sea Gem was the first British offshore oil rig.[184]

2005 Texas City Refinery explosion

In March 2005, BP's Texas City, Texas refinery, one of its largest refineries, exploded causing 15 deaths, injuring 180 people and forcing thousands of nearby residents to remain sheltered in their homes.[185] A 20-foot[186] column filled with hydrocarbon overflowed to form a vapour cloud, which ignited. The explosion caused all the casualties and substantial damage to the rest of the plant. The incident came as the culmination of a series of less serious accidents at the refinery, and the engineering problems were not addressed by the management. Maintenance and safety at the plant had been cut as a cost-saving measure, the responsibility ultimately resting with executives in London.[187]

The fallout from the accident continues to cloud BP's corporate image because of the mismanagement at the plant. There have been several investigations of the disaster, the most recent being that from the US Chemical Safety and Hazard Investigation Board[188] which "offered a scathing assessment of the company." OSHA found "organizational and safety deficiencies at all levels of the BP Corporation" and said management failures could be traced from Texas to London.[185]

The company pleaded guilty to a felony violation of the Clean Air Act, was fined $50 million, and sentenced to three years probation.

On 30 October 2009, the US Occupational Safety and Health Administration (OSHA) fined BP an additional $87 million, the largest fine in OSHA history, for failing to correct safety hazards revealed in the 2005 explosion. Inspectors found 270 safety violations that had been previously cited but not fixed and 439 new violations. BP appealed the fine.[185][189] (see #Environmental record).

In 2010, BP agreed to pay a settlement of $50.6 million for the safety violations that weren't fixed after the explosion. In July 2012, the company agreed to pay $13 million to settle the new violations. At that time OSHA found "no imminent dangers" at the Texas plant, which is up for sale. Thirty violations remain under discussion.[190]

2006–2010: Refinery fatalities and safety violations

From January 2006 to January 2008, three workers were killed at the company's Texas City, Texas refinery in three separate accidents. In July 2006 a worker was crushed between a pipe stack and mechanical lift, in June 2007, a worker was electrocuted, and in January 2008, a worker was killed by a 500-pound piece of metal that came loose under high pressure and hit him.[191]

Facing scrutiny after the Texas City Refinery explosion, two BP-owned refineries in Texas City, and Toledo, were responsible for 97 percent (829 of 851) of wilful safety violations by oil refiners between June 2007 and February 2010, as determined by inspections by the Occupational Safety and Health Administration. Jordan Barab, deputy assistant secretary of labour at OSHA, said "The only thing you can conclude is that BP has a serious, systemic safety problem in their company."[192]

Disclosed US diplomatic cables by WikiLeaks revealed that BP had covered up a gas leak and blowout incident in September 2008 at a gas field under production in the Azeri-Chirag-Guneshi area of the Azerbaijan Caspian Sea. According to the cables, BP was lucky to have been able to evacuate everyone safely given the explosive potential. BP did not only hold back information to the public about the incident but even upset its partner firms in limiting the information shared. In January 2009, BP blamed a bad cement job as the cause for the incident. The Guardian noted a striking resemblance with the later oil spill disaster in the Gulf of Mexico.[193]

2010 Deepwater Horizon well explosion

The 20 April 2010 explosion on BP's offshore drilling rig in the Gulf of Mexico resulted in the deaths of 11 people.[194][195][196] and injured 16 others; another 99 people survived without serious physical injury. It caused the Deepwater Horizon to burn and sink, and started the largest accidental offshore oil spill in the history of the petroleum industry[194][197][198]

Political record

Colombian pipeline

In July 2006, a group of Colombian farmers won a multi-million pound settlement from BP after the company was accused of benefiting from a regime of terror carried out by Colombian government paramilitaries to protect the 450-mile (720 km) Ocensa pipeline.[199]

Release of Lockerbie bomber

BP admitted that it had lobbied the British government to conclude a prisoner-transfer agreement which the Libyan government had wanted to secure the release of Abdelbaset al-Megrahi, the only person convicted for the 1988 Lockerbie bombing over Scotland, which killed 270 people. BP stated that it pressed for the conclusion of prisoner transfer agreement (PTA) amid fears that delays would damage its "commercial interests" and disrupt its £900 million offshore drilling operations in the region, but it denied claims that it had been involved in negotiations concerning the release of Megrahi.[200][201]

Contributions to political campaigns

According to the Center for Responsive Politics, BP is the United States' hundredth largest donor to political campaigns, having contributed more than US$5 million since 1990, 72% and 28% of which went to Republican and Democratic recipients, respectively. BP has lobbied to gain exemptions from US corporate law reforms.[202] Additionally, BP paid the Podesta Group, a Washington, D.C.-based lobbying firm, $160,000 in the first half of 2007 to manage its congressional and government relations.[203]

In February 2002, BP's chief executive, Lord Browne of Madingley, renounced the practice of corporate campaign contributions, noting: "That's why we've decided, as a global policy, that from now on we will make no political contributions from corporate funds anywhere in the world."[204]

Lobbying

In 2009 BP spent around US$16 million on the lobbying of the US Congress, breaking the company's previous record (from 2008) of US$10.4 million.[205]

See also

References

- ^ "Executive Compensation at BP". Retrieved 12 Jul. 2010.

{{cite web}}: Check date values in:|accessdate=(help)[dead link] - ^ a b c d e f "Annual Results 2011" (PDF). BP. 2 February 2010. Retrieved 11 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=(help) - ^ "BP plc 2009 Securities and Exchange Commission Form 20-F" (PDF) (Press release). BP plc. 2010. Retrieved 11 Jun. 2010.

{{cite press release}}: Check date values in:|accessdate=(help) - ^ "Across Atlantic, Much Ado About Oil Company's Name". The New York Times. 12 Jun. 2010. Retrieved 17 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=and|date=(help) - ^ "Global 500 – 1–100". Fortune. 25 July 2011. Retrieved 15 March 2012.

- ^ "Oil majors' output growth hinges on strategy shift". Reuters. 1 August 2008. Retrieved 15 March 2012.

- ^ a b Financial and Operating Information 2007–2011 (PDF) (Report). BP. 2011. p. 63.

- ^ Annual Report and Form 20-F 2011 (PDF) (Report). BP. 2011. p. 98. Retrieved 19 May 2012.

- ^ "BP enters shale oil quest in Ohio". UPI.com. 27 March 2012. Retrieved 19 May 2012.

- ^ "BP at a glance". BP.com. BP. Retrieved 19 May 2012.

- ^ "FTSE All-Share Index Ranking". stockchallenge.co.uk. Retrieved 26 December 2011.

- ^ "BP.com: History of BP – Post war". Retrieved 3 Jul. 2010.

In 1954, the board changed the company's name to The British Petroleum Company

{{cite web}}: Check date values in:|accessdate=(help) - ^ Tharoor, Ishaan (2 Jun. 2010). "A Brief History of BP". TIME magazine. Retrieved 3 Jul. 2010.

In 1954, in an attempt perhaps to move beyond its image as a quasi-colonial enterprise, the company rebranded itself the British Petroleum Company

{{cite news}}: Check date values in:|accessdate=and|date=(help) - ^ "BP tackles climate change threat with £200m boost for energy efficiency". London: The Telegraph. 25 October 2005. Retrieved 9 February 2011.

- ^ a b c "Australian Dictionary of Biography". Adb.online.anu.edu.au. Retrieved 5 June 2010.

- ^ Myers, Kevin (3 September 2009). "The greatest 20th century beneficiary of popular mythology has been the cad Churchill". Irish Independent.

- ^ Yousof Mazandi, United Press, and Edwin Muller, Government by Assassination (Reader's Digest September 1951).

- ^ "Britain Fights Oil Nationalism". The New York Times. Retrieved 5 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=(help) - ^ a b "BP: History at Funding Universe". Fundinguniverse.com. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=(help) - ^ Sztucki, Jerzy (1984). Interim measures in the Hague Court. Brill Archive. p. 43. ISBN 978-90-6544-093-8.

- ^ a b "How a Plot Convulsed Iran in '53 (and in '79)". The New York Times. Retrieved 5 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=(help) - ^ The C.I.A. in Iran: Britain Fights Oil Nationalism

- ^ "New York Times article, 1953". Partners.nytimes.com. 20 Aug. 1953. Retrieved 5 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=and|date=(help) - ^ Kinzer, All the Shah's Men, (2003), pp. 195–6.

- ^ Everest, Larry. "Background to Confrontation". Revcom.us. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=(help) - ^ "Natural Gas and Alaska's Future: The Facts page 22" (PDF). Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=(help) - ^ "BP dossier". Sea-us.org.au. 21 Nov. 1999. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=and|date=(help)[dead link] - ^ a b "Sohio timeline". Dantiques.com. 1 Jun. 1913. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=and|date=(help) - ^ "TNK International appoints Sir Peter Walters and Sir William Purves to its newly-created Advisory Board" (Press release). TNK International. 13 June 2002. Retrieved 5 June 2010.

- ^ Poole, Robert W. "Privatisation". Econlib.org. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=(help) - ^ Steve Lohr (19 November 1987). "Kuwait Has 10% Of B.P.; Price Put At $900 Million". The New York Times. Retrieved 11 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=(help) - ^ "Britain drops a barrier to BP bid". New York Times. Associated Press. 5 Feb. 1988. Retrieved 5 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=and|date=(help) - ^ "Organising for performance: how BP did it". Gsb.stanford.edu. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=(help) - ^ "Company Profile". chevron.com. Retrieved 5 May 2010.

- ^ "Royal Academy of Engineering". Raeng.org.uk. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=(help) - ^ "BP and Amoco in oil mega-merger". BBC News. 11 August 1998. Retrieved 5 June 2010.

- ^ a b "BP Parent Company Name Change Following AGM Approval" (Press release). BP. 1 May 2001. Retrieved 11 Jun. 2010.

{{cite press release}}: Check date values in:|accessdate=(help) - ^ Brierley, David (4 Apr. 1999). "BP strikes it rich in America". The Independent. London. Retrieved 5 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=and|date=(help) - ^ "BP Amoco Agrees Recommended Cash Offer To Buy Burmah Castrol For £3 ($4.7) Billion". BP.com. 14 March 2000. Retrieved 11 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=(help) - ^ Life: The Observer Magazine – A celebration of 500 years of British Art – 19 March 2000

- ^ "BP sells chemical unit for £5bn". BBC News. 7 October 2005. Retrieved 5 June 2010.

- ^ "BP Sale of Innovene to Ineos Completed" (Press release). BP. 15 December 2005. Retrieved 7 July 2012.

- ^ Raabe, Steve (2 June 2005). "BP puts 100 gas stations up for sale in Colorado.(British Petroleum Company PLC)". Accessmylibrary.com. Retrieved 5 June 2010.

- ^ "Gas station signs of change". Nl.newsbank.com. 18 Nov. 2005. Retrieved 5 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=and|date=(help) - ^ "Penny Shares Online: BP(BP.)". 10 July 2006. Archived from the original on 7 August 2007. Retrieved 11 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=(help) - ^ "BP to Sell Most Company-Owned, Company-Operated Convenience Stores to Franchisees" (Press release). BP. 15 Nov. 2007. Retrieved 5 Jun. 2010.

{{cite press release}}: Check date values in:|accessdate=and|date=(help) - ^ "BP CEO set to retire". Findarticles.com. 2007. Retrieved 5 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=(help); Unknown parameter|deadurl=ignored (|url-status=suggested) (help) [dead link] - ^ Ian Cobain and Clare Dyer (2 May 2007). "BP's Browne quits over lie". Guardian. London. Retrieved 5 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=(help) - ^ Young, Sarah; Falloon, Matt Falloon (30 September 2010). "New BP CEO says hopes to restore dividend in 2011". Reuters. Retrieved 30 January 2011.

- ^ "BP and Russia in Arctic oil deal". BBC News. 14 January 2011.

- ^ "Rosneft and BP Form Global and Arctic Strategic alliance". Rosneft. 14 January 2011.

- ^ "BP announces $7.2B partnership with India's Reliance". New York Post. 21 February 2011.

- ^ http://www.nytimes.com/2012/06/02/business/global/bp-to-seek-sale-of-russian-venture-tnk-bp.html

- ^ BP's Russian retreat could be best pragmatic outcome … if price is right | Business | guardian.co.uk

- ^ "BP plc". nyse.com. NYSE Euronext. Retrieved 21 June 2012.

- ^ "BP Profile". Yahoo! Finance. Retrieved 7 June 2012.

- ^ "BP on the mend, but recuperation will take time". Petroleum Economist. 28 October 2010. Retrieved 15 May 2012.

- ^ "BP: Summary". Google Finance. Google. Retrieved 6 June 2012.

- ^ a b c d e f g Annual Report and Form 20-F 2011 (PDF) (Report). BP. 6 March 2012. Retrieved 6 June 2012.

- ^ a b "UK: Welcome". bp.com. BP. Retrieved 19 June 2012.

- ^ "BP's presence in the US". BP Magazine. BP. 2012. Retrieved 12 June 2012.

- ^ "Group organization". bp.com. BP. 18 June 2012. Retrieved 18 June 2012.

- ^ "Country Analysis Briefs: United Kingdom". eia.gov. Energy Information Administration. September 2011. Retrieved 22 July 2012.

- ^ "Our priorities for managing our people". Our priorities. BP.com. Retrieved 12 July 2012.

- ^ a b Ian Forsyth (28 July 2010). "BP will retain significant presence in North Sea, says operations chief". Aberdeen Press and Journal. Retrieved 7 July 2012.

- ^ Richard Wachman (13 October 2011). "BP to expand North Sea oil fields". The Guardian. Retrieved 19 June 2012.

- ^ "On the up for BP's North Sea business". BP Magazine. BP. 2012. Retrieved 22 July 2012.

- ^ a b "U.K. Nod for BP Clair Ridge". Zacks Investment Research. 17 October 2011. Retrieved 10 July 2012.

- ^ a b c Tom Bawden (14 October 2011). "BP to pump £4.5bn into North Sea projects". The Independent. Retrieved 10 July 2012.

- ^ a b "BP activities in the UK". bp.com. BP. Retrieved 10 July 2012.

- ^ Brian Swint (13 October 2011). "BP, Shell, Conoco Get Approval For Clair Ridge In North Sea". Bloomberg. Retrieved 27 June 2012.

- ^ Michael Kavanagh (27 March 2012). "BP to sell $400m N Sea assets to Perenco". Financial Times. Retrieved 10 July 2012.

- ^ Florence Tan (30 September 2009). "EPCA '07: BP to debottleneck Hull acetic acid unit". ICIS.com. Retrieved 10 July 2012.

- ^ "Advanced biofuels". bp.com. BP. Retrieved 10 July 2012.

- ^ Rudy Ruitenberg (10 April 2012). "Vivergo Ethanol Plant in U.K. Gets Wheat, Frontier Says". Businessweek. Retrieved 10 July 2012.

- ^ Paul Spackman (15 June 2012). "Cereals 2012: Bioethanol plant on track for summer start". Farmers Weekly. Retrieved 10 July 2012.

- ^ a b "Locations". BP. Retrieved 6 July 2012.

- ^ "BP Service Stations: About the BP network". bp.com. BP. Retrieved 27 June 2012.

- ^ "Store Level: BP Connect". Talking Retail. 24 February 2005. Retrieved 10 July 2012.

- ^ Rod Addy (3 July 2004). "Connect stores outstrip BP forecasts". The Grocer. Retrieved 10 July 2012.

- ^ "M&S Simply Food at BP Connect". bp.com. BP. Retrieved 10 July 2012.

- ^ Courtney Subramanian (29 April 2011). "While BP Eyes Return to the Gulf, Safeguards Debated". National Geographic. Retrieved 19 June 2012.

- ^ Ben Lefebrve (23 June 2012). "BP, Apache Evacuate Nonessential Staff From U.S. Gulf as Storm Nears". Fox Business News. Dow Jones Newswires. Retrieved 27 June 2012.

- ^ "Member Companies". aoga.org. Alaska Oil and Gas Association. Retrieved 19 June 2012.

- ^ Zaz Hollander (May 2012). "Following North Slope Crude: From the ground to the gas station". Alaska Business Monthly. Retrieved 21 June 2012.

- ^ Bob Downing (27 March 2012). "British Petroleum takes stage in Ohio shale". ohio.com. Retrieved 18 June 2012.

- ^ Bill Bowen (4 April 2012). "BP wind energy goes full blast in Texas". Dallas News. Retrieved 18 June 2012.

- ^ a b Deon Daugherty (27 April 2012). "BP alternative energy division moves HQ to Houston". Houston Business Journal. Retrieved 7 June 2012.

- ^ "BP Biofuels confirms 2012 groundbreaking for US cellulosic ethanol project". Biofuels Digest. 24 June 2011. Retrieved 21 June 2012.

- ^ Alexis Flynn (6 March 2012). "BP Expands Brazil Exploration Footprint". Retrieved 19 June 2012.

- ^ Lada Yevgrashina (1 March 2012). "BP to boost investment in Azeri projects in 2012". Reuters. Retrieved 21 June 2012.

- ^ "BP eyes new work in Trinidad and Tobago". UPI.com. 15 May 2011. Retrieved 21 June 2012.

- ^ "BP gets OK for deepwater gas exploration". China.org.cn. 15 February 2012. Retrieved 21 June 2012.

- ^ "BP reaches production milestone in Iraq". UPI.com. 12 January 2011. Retrieved 21 June 2012.

- ^ Agus Suhana (27 May 2011). "BP Plans To Invest $10 Billion In Indonesia In Next 10 Years". Bloomberg. Retrieved 21 June 2012.

{{cite news}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - ^ Amol Sharma (21 February 2011). "BP to Make Big India Investment". Wall Street Journal. Retrieved 21 June 2012.

{{cite news}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - ^ Jeff Fick (14 March 2011). "BP Expands Biofuels Business In Brazil". Wall Street Journal. Retrieved 19 June 2012.

{{cite news}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - ^ "BP expands Brazil ethanol operations". Reuters Africa. 14 September 2011. Retrieved 21 June 2012.

- ^ a b "BP". Forbes. Retrieved 18 June 2012.

- ^ "BP PLC Company Description". CNN Money. 1 April 2011. Retrieved 7 June 2012.

- ^ "Profile: BP PLC (BP)". Reuters. Retrieved 7 June 2012.

- ^ "Marine Assurance". Bp.com. 1 January 2008. Retrieved 17 July 2010.

- ^ "BP Shipping Fleet". Bp.com. Retrieved 17 July 2010.

- ^ "BP to invest £650 million plus in alt energy". Reuters. 17 April 2010. Retrieved 7 June 2012.

- ^ "BP turns out lights at solar business". Reuters UK. 21 December 2011. Retrieved 21 June 2012.

- ^ a b Murray, Terrence (1 February 2011). "BP Plans $1B Wind, biofuel Investments For 2011". International Business Times. Retrieved 7 July 2012.

- ^ "Solar Completes Manufacturing Restructuring With Closure of Frederick, MD Factory | Press". BP. 26 March 2010. Retrieved 17 July 2010.

- ^ a b Renewables Growth to Outpace Oil, Gas Through 2030, BP Says - Businessweek

- ^ Bergin, Tom; Young, Sarah (21 December 2011). "BP turns out lights at solar business". Reuters. Retrieved 21 December 2011.

- ^ BP Alternative Energy - Solar power

- ^ "The Board". BP. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=(help) - ^ UK Companies House website

- ^ P.R. WEEK, US EDITION, 17 April 2000, P23.

- ^ “Charlex creates BP spot” www.charlex.com/news/BP/BP.press.html

- ^ "Beyond petroleum". BP. Retrieved 6 May 2010.

- ^ "The 10 Worst Corporations of 2005". Multinationalmonitor.org. 14 Oct. 2005. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=and|date=(help) - ^ "bp: Beyond Petroleum?". Uow.edu.au. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=(help)[dead link] - ^ "SaveTheArctic.com". SaveTheArctic.com. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=(help) - ^ "Main Home". Energy Biosciences Institute. 27 Jul. 2006. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=and|date=(help) - ^ "Stop BP-Berkeley". Stop BP-Berkeley. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=(help) - ^ GB application 1435945, British Petroleum CO, "Oil Clean-Up Method", published 12 May 1976

- ^ Michael Sanderson (2002). The History of the University of East Anglia. Hambledon and London. Retrieved 15 Oct. 2010.

{{cite book}}: Check date values in:|accessdate=(help) - ^ "Global Climate Coalition". Sourcewatch. Retrieved 11 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=(help) - ^ mindfully.org (13 Feb. 2001). "How green is BP?". Mindfully.org. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=and|date=(help) - ^ "Scripps Institution". Scrippsco2.ucsd.edu. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=(help) - ^ BBC NEWS | Science & Environment | BP brings 'green era' to a close

- ^ BP turns out lights at solar business | Reuters

- ^ Interviewer: Amy Goodman, Guest: Antonia Juhasz (5 May 2010). "BP Funnels Millions into Lobbying to Influence Regulation and Re-Brand Image". Amy Goodman's Weekly Column. Democracy Now.

{{cite episode}}: Cite has empty unknown parameter:|serieslink=(help) - ^ Carbon Scam: Noel Kempff Climate Action Project and the Push for Sub-national Forest Offsets Sub-prime carbon brought to you by AEP, BP, and Pacificorp, Greenpeace 10/2009 pages 4–5

- ^ Monbiot, George (13 June 2006). "Behind the spin, the oil giants are more dangerous than ever (column)". The Guardian. London. Retrieved 26 April 2010.

- ^ "BP beyond petroleum? Not just yet". The Scotsman. 26 October 2005. Retrieved 5 June 2010.

- ^ "BP wins coveted 'Emerald Paintbrush' award for worst greenwash of 2008". Greenpeace.org.uk. 22 December 2008. Retrieved 1 May 2010.

- ^ "BP – nominated for green spin on the activities of the company". Climategreenwash.org. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=(help)[dead link] - ^ "BP Exploration [Alaska] Pleads Guilty To Hazardous Substance Crime Will Pay $22 Million, Establish Nationwide Environmental Management System". United States Environmental Protection Agency. 23 September 1999. Retrieved 11 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=(help) - ^ Tran, Mark (19 July 2006). "BP shuts leaking Alaskan wells". The Guardian. London. Retrieved 7 July 2012.

- ^ Roach, John (20 March 2006). "Alaska Oil Spill Fuels Concerns Over Arctic Wildlife, Future Drilling". National Geographic. Retrieved 5 June 2010.

- ^ "Alaska Update". BP. 2 October 2006.

- ^ Andrew Clark in New York (1 May 2007). "BP accused of 'draconian' cost cuts prior to Alaskan pipeline spill". Guardian. London. Retrieved 5 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=(help) - ^ "Methanol and crude spill from Prudhoe Bay pipeline". 2 News KTUU.com. Associated Press. 16 October 2007. Archived from the original on 13 November 2007. Retrieved 11 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=(help) - ^ a b Yevgrashina, Lada (17 September 2008). "BP halves Azeri oil production after gas leak". Reuters. Retrieved 1 July 2012.

- ^ a b Gismatullin, Eduard (17 September 2008). "BP Shuts Down Two Azeri Oil Platforms After Gas Leak". Bloomberg. Retrieved 1 July 2012.

- ^ a b Walt, Vivienne (1 July 2010). "WikiLeaks: BP's 'Other' Offshore Drilling Disaster". Time. Retrieved 1 July 2012.

- ^

US Embassy in Azerbaijan (8 October 2008). US embassy cables: BP may never know cause of gas leak, US told. The Guardian (Report). Retrieved 1 July 2012.

{{cite report}}: Unknown parameter|trans_title=ignored (|trans-title=suggested) (help) - ^

US Embassy in Azerbaijan (15 January 2009). US embassy cables: BP blames gas leak on 'bad cement job'. The Guardian (Report). Retrieved 1 July 2012.

{{cite report}}: Unknown parameter|trans_title=ignored (|trans-title=suggested) (help) - ^ Yevgrashina, Lada (10 October 2008). "BP resumes oil output at one Azeri platform". Reuters. Retrieved 1 July 2012.

- ^ Yevgrashina, Lada (23 December 2008). "BP partially resumes production at Azeri platform". Reuters. Retrieved 1 July 2012.

- ^ By T.J. Aulds (5 June 2010). "The Galveston County Daily News". Galvestondailynews.com. Retrieved 17 July 2010.

- ^ "BP Texas Refinery Had Huge Toxic Release Just Before Gulf Blowout". ProPublica. Retrieved 17 July 2010.

- ^ More than 50,000 Texas City residents sue BP | abc13.com

- ^ Gulf oil spill's vastness confirmed: Largest marine oil accident ever

- ^ http://www.nytimes.com/2010/08/03/us/03spill.html

- ^ BP leak the world's worst accidental oil spill - Telegraph

- ^ US to give BP evidence on size of Gulf oil spill - Chicago Tribune

- ^ One Year After BP Oil Spill, At Least 1.1 Million Barrels Still Missing: Scientific American

- ^ "Oil estimate raised to 35,000–60,000 barrels a day". CNN. 15 Jun. 2010. Retrieved 15 Jun. 2010.

{{cite news}}:|first=has generic name (help);|first=missing|last=(help); Check date values in:|accessdate=and|date=(help) - ^ "How many gallons spilled?". Retrieved 17 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=(help) - ^ Macdonald, Ian R.; Amos, John; Crone, Timothy; Wereley, Steve (21 May 2010). "The Measure of an Oil Disaster". The New York Times. Retrieved 1 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=(help); More than one of|first1=and|first=specified (help); More than one of|last1=and|last=specified (help) - ^ Gillis, Justin (18 May 2010). "Giant Plumes of Oil Forming Under the Gulf". The New York Times. Retrieved 18 May 2010.

- ^ BP Investigated on Oil-Leak Estimates - WSJ.com

- ^ Bigg, Matthew (3 May 2010). "Progress toward Gulf oil well cap". Reuters. Retrieved 13 May 2010.

- ^ "BP vows to pay all costs of oil spill cleanup". CBC. CBC News services. 3 May 2010. Retrieved 10 May 2010.

- ^ Daily Mail special investigation article: Why is BP taking ALL the blame? http://www.dailymail.co.uk/news/article-1287226/GULF-OIL-SPILL-Whys-BP-taking-blame.html

- ^ Gulf Oil Spill: BP Says Oil Stops Leaking in Test for First Time in 87 Days - ABC News

- ^ Oil Spill: BP’s Relief Well Successfully Intersects | Science and Space | TIME.com

- ^ BP settles while Macondo 'seeps' - Features - Al Jazeera English

- ^ Rocky Kistner: The Macondo Monkey on BP's Back

- ^ "2010–2011 Cetacean Unusual Mortality Event in Northern Gulf of Mexico – Office of Protected Resources – NOAA Fisheries". Nmfs.noaa.gov. 1 November 2011. Retrieved 5 November 2011.

- ^ 2010-2012 Cetacean Unusual Mortality Event in Northern Gulf of Mexico - Office of Protected Resources - NOAA Fisheries

- ^ Whale and dolphin death toll during Deepwater disaster may have been greatly underestimated

- ^ Dahr Jamail. "Gulf seafood deformities alarm scientists – Features". Al Jazeera English. Retrieved 1 June 2012.

- ^ Ted Jackson, The Times-Picayune. "Spilled BP oil lingers on Louisiana coast". NOLA.com. Retrieved 1 June 2012.

- ^ "Salazar: Oil spill 'massive' and a potential catastrophe". CNN. 2 May 2010. Retrieved 1 May 2010.

- ^ "Guard mobilized, BP will foot bill". Politico. Capitol News Company LLC. 1 May 2010. Retrieved 1 May 2010.

- ^ a b Brenner, Noah (17 Jun. 2010). "Hayward says spill 'never should have happened'". Upstream Online. NHST Media Group. Retrieved 17 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=and|date=(help) - ^ "White House: BP Will Pay $20B Into Gulf Spill Fund". NPR. 16 Jun. 2010.

{{cite news}}: Check date values in:|date=(help) - ^ Weisman, Jonathan; Chazan, Guy (16 Jun. 2010). "BP Halts Dividend, Agrees to $20 Billion Fund for Victims". The Wall Street Journal. Dow Jones & Company. Retrieved 16 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=and|date=(help) - ^ "BP to fund $20bn Gulf of Mexico oil spill payout". BBC News. 16 Jun. 2010. Retrieved 16 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=and|date=(help) - ^ "STATE OF ALABAMA et al v. BP, PLC et al". ACE Insurance Litigation Watch. 28 June 2010.

{{cite news}}: Text "]" ignored (help) - ^ BP agrees £4.9billion settlement over Gulf of Mexico oil spill | Metro.co.uk

- ^ Earthjustice Asks UN & International Joint Commission to Address Mining and Gas Drilling Threats To Glacier National Park[dead link]

- ^ Citizens concerned about project

- ^ The tactics of these rogue climate elements must not succeed.

- ^ Cree aboriginal group to join London climate camp protest over tar sands.

- ^ "The Story of the Sea Gem, the first rig to discover North Sea Gas in the UK sector". Dukes Wood Oil Museum. Retrieved 13 June 2010.

- ^ a b c ""Gulf oil spill: BP has a long record of legal, ethical violations" 8 May 2010 by McClatchy Washington Bureau". Mcclatchydc.com. Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=(help) - ^ http://www.nytimes.com/2010/07/13/business/energy-environment/13bprisk.html?pagewanted=3

- ^ "Baker Panel Report". Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=(help) - ^ "U.S. Chemical Safety And Hazard Investigation Board Investigation Report on the BP Refinery Explosion and Fire of 23 March 2005 and BP's Safety Culture" (PDF). Retrieved 5 Jun. 2010.

{{cite web}}: Check date values in:|accessdate=(help) - ^ Associated Press, "BP fined record $87 million for safety breaches", 31 October 2009.

- ^ UPDATE 2-BP pays $13 mln to settle Texas refinery safety probe | Reuters

- ^ Mark Collette (17 January 2008). "Attorney: Equipment failed in BP death". The Daily News. Retrieved 11 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=(help) - ^ J. Morris and M.B. Pell (16 May 2010). "Renegade Refiner: OSHA Says BP Has "Systemic Safety Problem"". The Center for Public Integrity. Retrieved 11 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=(help) - ^ Tim Webb (16 Dec. 2010). "WikiLeaks cables: BP suffered blowout on Azerbaijan gas platform". The Guardian. UK. Retrieved 16 Dec. 2010.

{{cite news}}: Check date values in:|accessdate=and|date=(help) - ^ a b Estimates Suggest Spill Is Biggest in U.S. History

- ^ ""Bird Habitats Threatened by Oil Spill" from National Wildlife". National Wildlife Federation. 30 Apr. 2010. Retrieved 3 May 2010.

{{cite web}}: Check date values in:|date=(help) - ^ Gulf Oil Slick Endangering Ecology (web streaming). CBS Broadcasting. 30 Apr. 2010. Retrieved 1 May 2010.

{{cite AV media}}: Check date values in:|date=(help) - ^ ""Bird Habitats Threatened by Oil Spill" from National Wildlife". National Wildlife Federation. 30 April 2010. Retrieved 3 May 2010.

- ^ Gulf Oil Slick Endangering Ecology (web streaming). CBS Broadcasting. 30 April 2010. Retrieved 1 May 2010.

- ^ Verkaik, Robert (22 Jul. 2006). "BP pays out millions to Colombian farmers". The Independent. London. Retrieved 5 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=and|date=(help) - ^ BP admits 'lobbying UK over Libya prisoner transfer scheme but not Lockerbie bomber' - Telegraph

- ^ BP's admits role in Lockerbie bomber's release - SFGate

- ^ "BP". The Center For Responsive Politics.

- ^ "BP". The Center for Responsive Politics.

- ^ Terry Macalister and Michael White (16 April 2002). "BP stops paying political parties". Guardian. London. Retrieved 5 Jun. 2010.

{{cite news}}: Check date values in:|accessdate=(help) - ^ Juhasz, Antonia (2 May 2010). "BP spends millions lobbying as it drills ever deeper and the environment pays". The Observer. UK. Retrieved 6 May 2010.

Further reading

- Ferrier, R.W. (1982). The History of the British Petroleum Company: The Developing Years 1901–1932. Vol. vol. I. Cambridge: Cambridge University Press. ISBN 0-521-24647-4.

{{cite book}}:|volume=has extra text (help) - Bamberg, James H (1994). The History of the British Petroleum Company: The Anglo-Iranian Years, 1928–1954. Vol. vol. II. Cambridge: Cambridge University Press. ISBN 0-521-25950-9.

{{cite book}}:|volume=has extra text (help) - Bamberg, James H (2000). The History of the British Petroleum Company: British Petroleum and Global Oil, 1950–1975: The Challenge of Nationalism. Vol. vol. III. Cambridge: Cambridge University Press. ISBN 0-521-25951-7.

{{cite book}}:|volume=has extra text (help) - Meyer, Karl E (2008). Kingmakers: The Invention of the Modern Middle East. New York: W.W. Norton. ISBN [[Special:BookSources/97803930619944 |97803930619944 [[Category:Articles with invalid ISBNs]]]].

{{cite book}}: Check|isbn=value: invalid character (help); Unknown parameter|coauthors=ignored (|author=suggested) (help)

External links

Official

Other

- BP companies grouped at OpenCorporates

- Company details, list of subsidiaries, and major shareholders

- Use dmy dates from July 2011

- Automotive fuel brands

- BP

- British brands

- Chemical companies of the United Kingdom

- Companies based in DuPage County, Illinois

- Companies based in Houston, Texas

- Companies based in London

- Companies established in 1909

- Companies listed on the London Stock Exchange

- Companies listed on the New York Stock Exchange

- Economy of Alaska

- Multinational companies headquartered in the United Kingdom

- Oil and gas companies of the United Kingdom

- Oil pipeline companies

- Orphan initialisms

- 1909 establishments in the United Kingdom

- Companies formerly listed on the Tokyo Stock Exchange